EU Solar Market to Shrink 1.4% in 2025, First Decline Since 2015

Residential rooftop slowdown and weak cPPA deals drove the EU’s solar slowdown

August 7, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

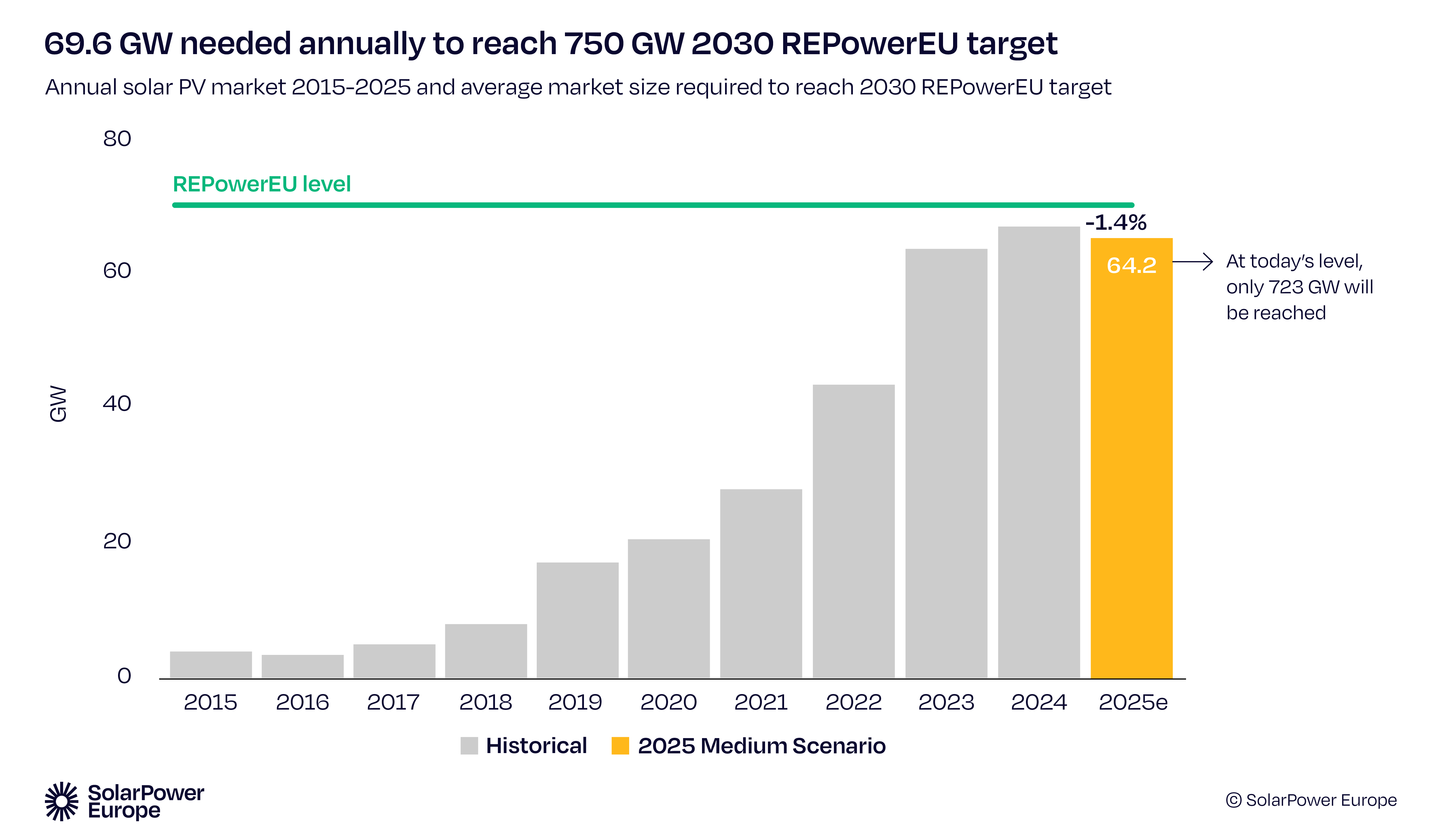

The European Union (EU) is projected to install 64.2 GW of new solar capacity in 2025, down from 65.1 GW in 2024, a projected 1.4% annual decline, the first since 2015, according to SolarPower Europe’s mid-year market report. The projected decrease will be driven by the shrinking residential rooftop market.

This expected downturn follows sharp growth in 2022 (47%) and 2023 (51%), and stagnation in 2024 (3.3%).

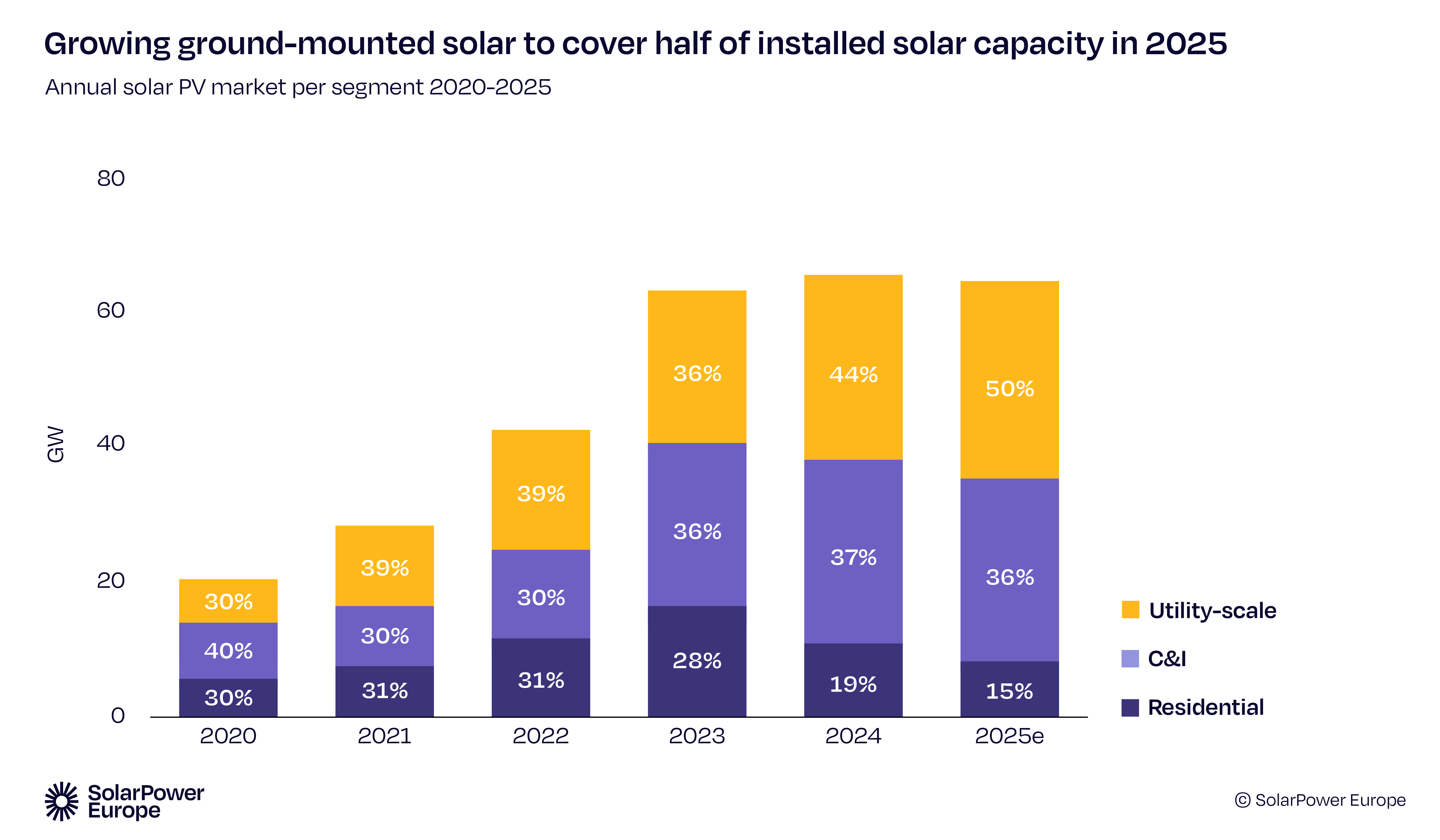

Despite the expected slowdown, total installed solar capacity will reach 402 GW by year-end, meeting the EU’s RePowerEU 2025 target. However, the residential rooftop segment is likely to collapse by over 60% in countries like Italy, the Netherlands, Austria, Belgium, Czechia, and Hungary, while corporate PPAs have dropped 41% between the first and the second quarter (Q2), threatening future utility-scale growth.

Residential Rooftop Decline

According to the report, the EU’s solar sector slowdown is concentrated in markets that were previously strong performers, including Italy, the Netherlands, Austria, Belgium, Czechia, and Hungary. In these countries, rooftop solar installations are expected to fall by more than 60% compared to 2023 levels.

The decline is attributed to the easing of the 2022 energy crisis and the expiry of government support schemes, many of which have not been replaced. Even in other large markets such as Germany, Spain, and Poland, rooftop installations are expected to fall by over 40%.

Analysts cite policy instability, lack of replacement incentives, and lower electricity prices as contributing factors. Many households are reconsidering the return on investment from rooftop systems in the absence of subsidies, net metering benefits, or urgent price pressures.

Utility-Scale Solar Stable

While residential installations are reducing, the utility-scale solar segment is expected to remain relatively stable in 2025, contributing around half of the new capacity additions.

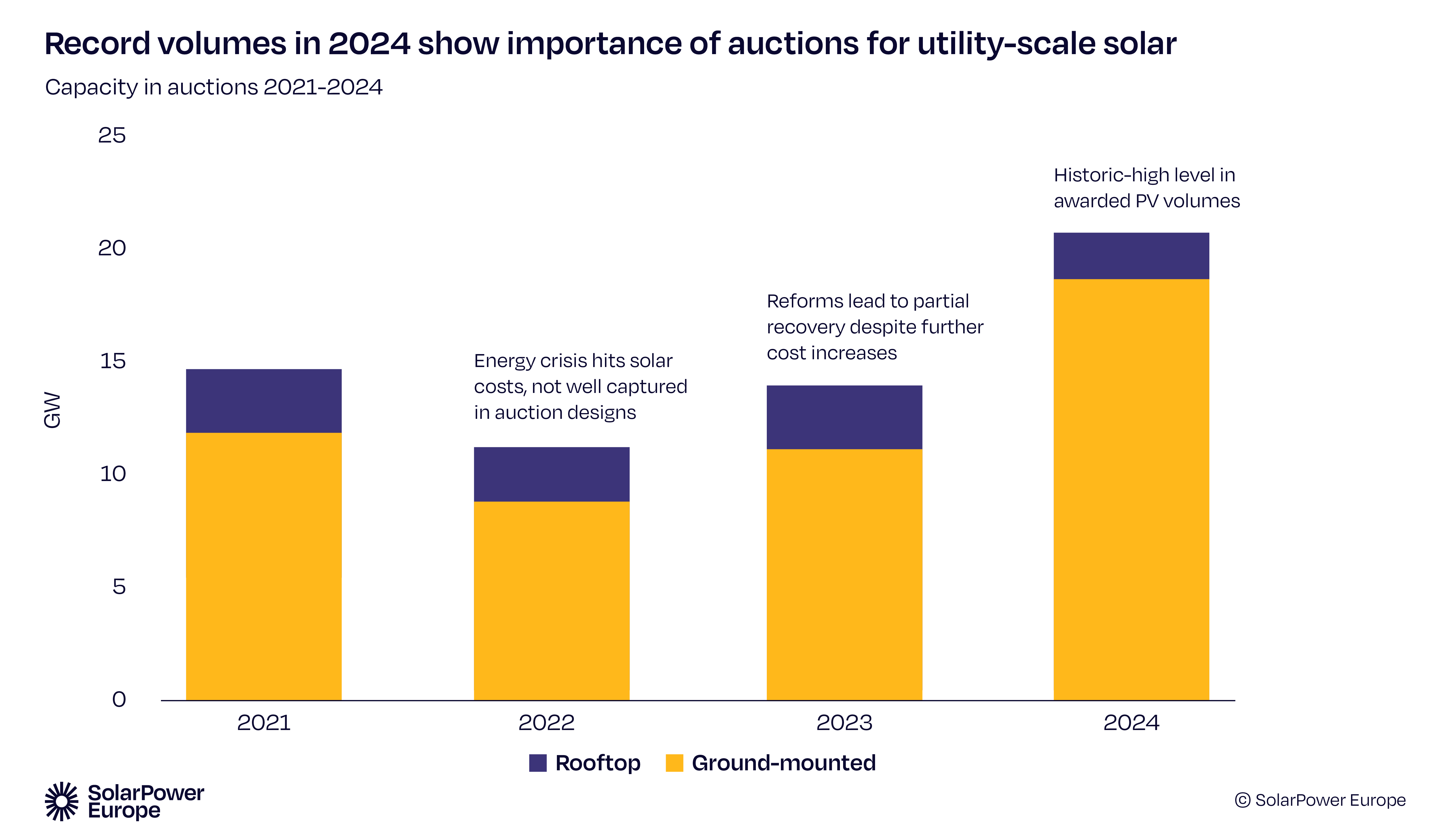

In 2024, a record 20 GW of utility-scale solar capacity was awarded through auctions across the EU. Germany leads the region in auction activity, followed by the Netherlands, France, and Italy.

Poland and Ireland are also increasing their auction volumes. Notably, Germany’s most recent innovation tender attracted 158 bids totalling more than 2 GW, mostly for hybrid solar-storage systems.

The auction cleared at €0.05 (~$0.058)/kWh, down from €0.07 (~$0.081)/kWh in a similar October 2024 tender that awarded just 487 MW, indicating increased competition and falling costs.

Hybridization is playing a growing role in utility-scale deployment. Co-located battery storage or wind-solar hybrid projects are gaining preference in national tenders, particularly in Germany and Bulgaria, enabling better load management and improving solar integration into the grid.

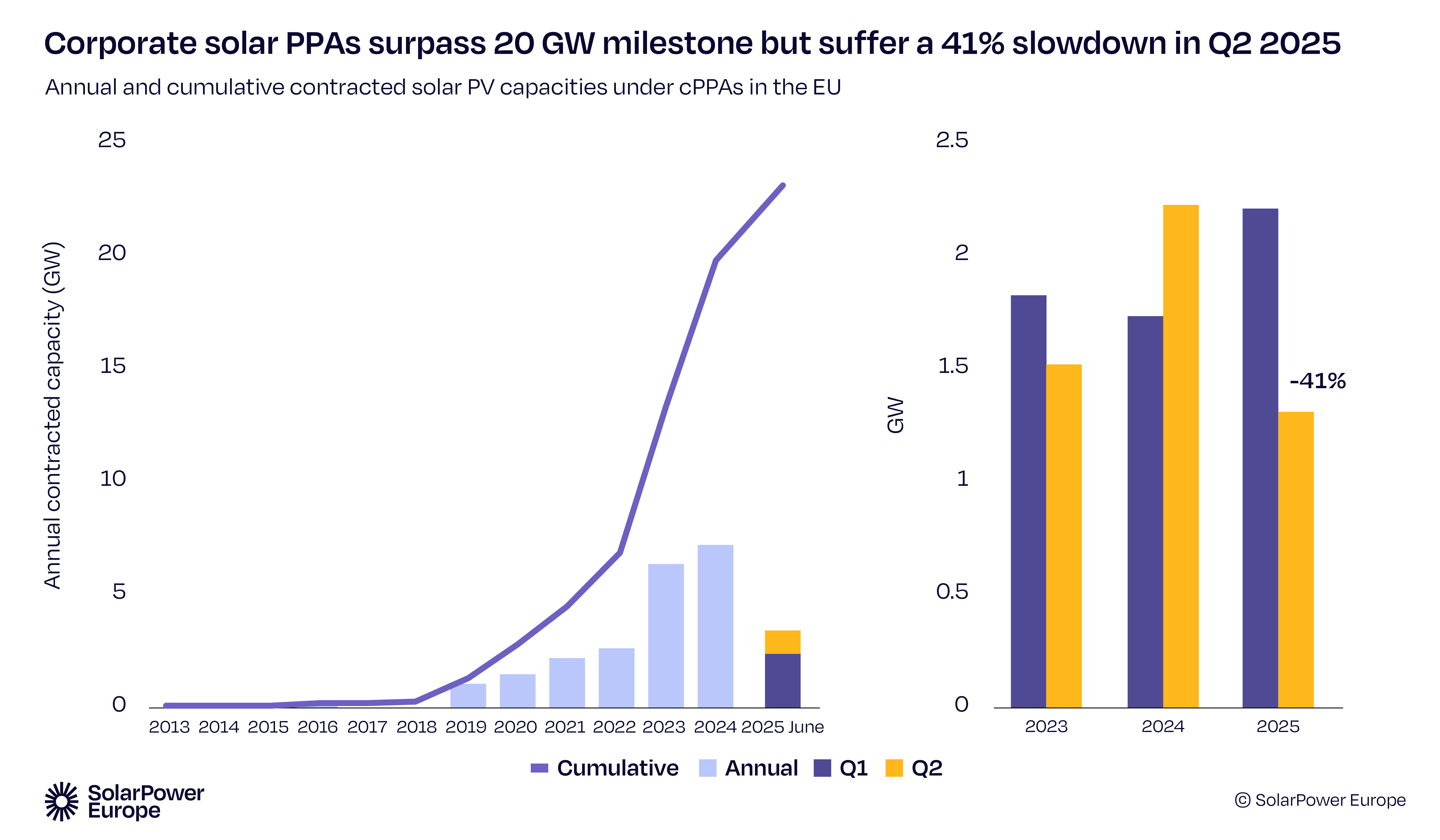

Corporate PPA Market

According to the report, the corporate Power Purchase Agreement (cPPA) segment, which has been a key enabler of utility-scale solar development in recent years, is now weakening. In 2025, the volume of new solar cPPA contracts fell by 41% between Q1 and Q2.

The decline was driven by falling electricity prices, which made long-term solar PPAs less attractive to corporate buyers. Without additional policy support, this trend could further undermine long-term investment in utility-scale solar projects. SolarPower Europe has called for stronger frameworks to support cPPAs and ensure stable financing for solar deployment.

Europe’s solar PPA prices in the Market-Averaged Continental Index rose by just 1% in the previous quarter, according to a report by LevelTen. Europe’s renewable energy sector has entered a pricing maturity and predictability phase.

EU Risks Falling Short of 2030 Target

Despite achieving its 2025 RePowerEU target, reaching the 2030 goal of 750 GW remains uncertain for the EU. To stay on track, the region must install close to 70 GW of new capacity annually starting in 2026.

At the current rate, the EU will only reach 723 GW by 2030, falling short of the target. Dries Acke, Deputy CEO at SolarPower Europe, warned that a market decline at this critical stage is a serious concern.

He urged EU policymakers to act by strengthening regulatory frameworks around electrification, system flexibility, and energy storage to maintain momentum through the decade.

Recently, Wood Mackenzie’s Global Solar Inverter Market Share report showed that Europe experienced a double-digit percentage decline, especially in the residential and commercial segments. This drop was driven by excess inventory in key markets such as Germany and the Netherlands.