Energy Storage Sees Increased VC Investment Momentum in 2025

Funding for energy storage dropped by 19% year-over-year

February 3, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

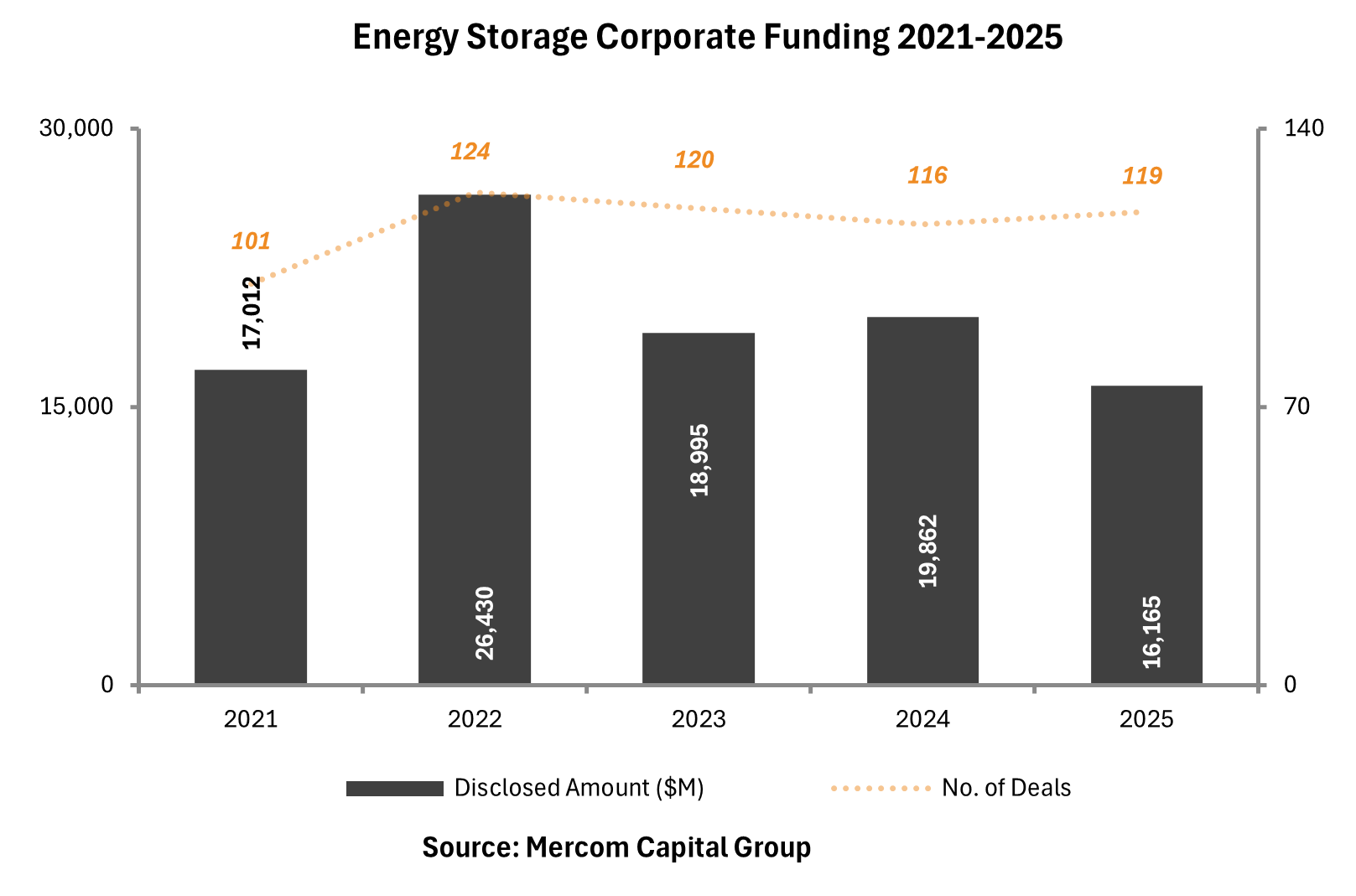

Venture capital investment in energy storage gained momentum in 2025, rising 30% year over year to $4.8 billion across 75 deals, even as total corporate funding for the sector declined 19% to $16.2 billion, according to Mercom Capital Group’s Annual and Q4 2025 Funding and M&A Report for Energy Storage.

Overall corporate funding totaled $16.2 billion across 119 deals in 2025, down from $19.9 billion raised through 116 deals in 2024. Despite the decline in total capital raised, deal activity increased 3% during the year, indicating continued investor engagement in the sector.

The drop in funding was largely due to the absence of exceptionally large debt transactions that had inflated totals in 2024. “In 2024, we had some really massive deals that we’ve never seen before. One European battery company alone raised about $5 billion in debt and later went bankrupt. These one-off deals made 2024 look extremely strong, and when you compare 2025 to that, it naturally appears weaker,” said Raj Prabhu, CEO of Mercom Capital Group.

Prabhu noted that debt and public market financing primarily reflects activity among a small group of publicly listed battery companies, while venture capital provides a clearer signal of market health and technology development.

Energy storage downstream companies attracted the largest share of VC funding in 2025, followed by materials and components suppliers, energy storage system providers, battery recycling firms, and lithium-based battery companies.

“The energy storage market adjusted to a more complex policy and financing environment in 2025. While total funding declined, investment activity remained resilient, with venture capital increasingly directed toward companies aligned with current incentive structures. Energy storage clearly emerged as a winner under the OBBB, with the preservation of investment tax credits for standalone battery storage and production tax credits supporting continued investment amid rising data center-driven power demand. Project M&A activity also remained strong, reinforcing sustained demand for energy storage assets,” Prabhu said.

The largest VC deals announced during the year included Base Power’s $1 billion raise, KoBold Metals’ $537 million round, Group14 Technologies’ $463 million financing, green flexibility’s $411 million raise, and Redwood Materials’ $350 million funding round.

Debt and public market financing for energy storage companies declined 30% year over year to $11.4 billion across 44 deals in 2025. Corporate M&A activity edged lower, with 22 acquisitions recorded during the year, compared with 25 in 2024.

In contrast, project-level M&A strengthened significantly, with 65 energy storage project transactions announced in 2025, underscoring sustained demand for operating and late-stage energy storage assets.

Smart Grid

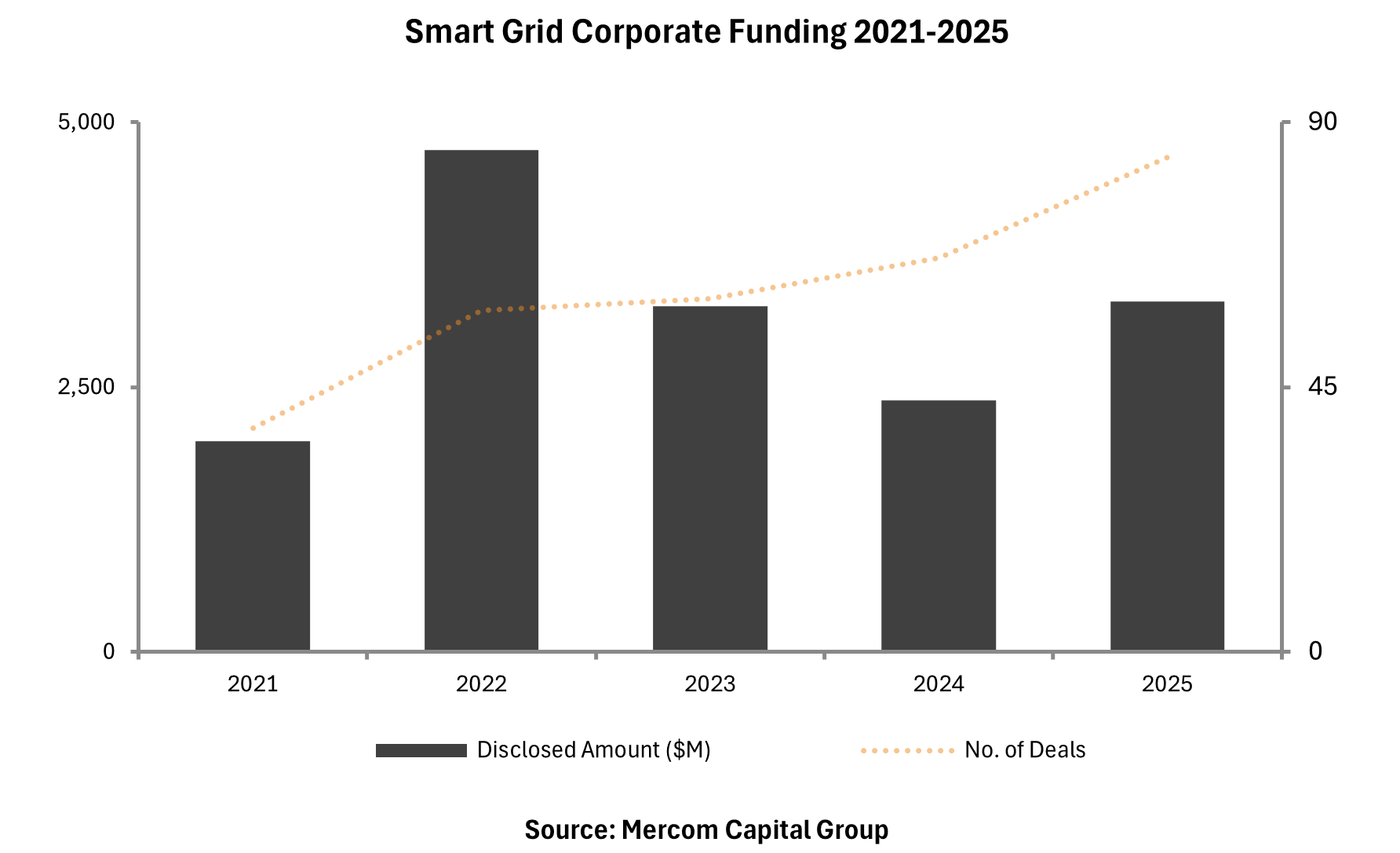

Corporate funding for smart grid companies rose 38% year-over-year to $3.3 billion across 84 deals, up from $2.4 billion across 67 deals in 2024, according to Mercom Capital Group’s Annual and Q4 2025 Funding and M&A Report for Smart Grid. Deal activity increased 25% during the year.

Venture capital funding for smart grid companies reached $1.8 billion across 68 deals in 2025, up 6% from $1.7 billion across 56 deals in 2024. Investment was driven primarily by smart charging companies, followed by grid optimization, distributed generation and integration, communications, and data analytics firms.

Prabhu said smart charging continued to attract capital despite slower electric vehicle sales growth in some markets. “Without charging infrastructure, EVs cannot function. The market understands that EVs are the future, so investment keeps flowing,” he said, citing strong momentum in Europe and the UK.

Beyond EV charging, grid stability emerged as a key investment theme as renewable energy additions accelerated. “With so much intermittent solar and wind being added, especially in Europe and the U.S., grid stability is no longer what it was before,” Prabhu said. “Funding is naturally moving toward technologies that can address these challenges.”

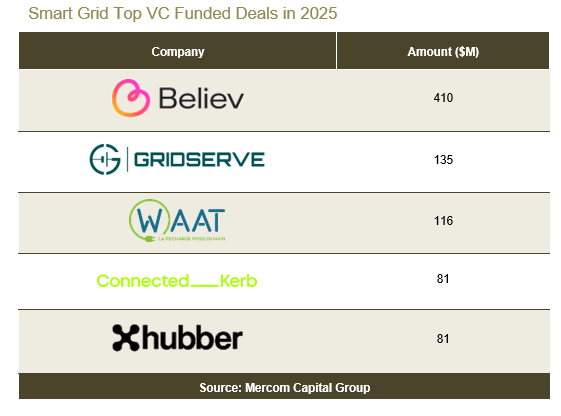

The largest smart grid VC funding rounds in 2025 included Believ’s $410 million raise, GRIDSERVE’s $135 million round, WAAT’s $116 million financing, and $81 million rounds for both Connected Kerb and Hubber.

Debt and public market financing in the smart grid sector more than doubled year over year to $1.5 billion across 16 deals in 2025, up from $718 million across 11 deals in 2024, with deal activity rising 45%.

Corporate M&A activity remained largely stable, with nine smart grid companies acquired in 2025, compared with 10 in 2024, although only one transaction disclosed financial terms.

To learn more about the energy storage report, visit: https://mercomcapital.com/product/annual-q4-2025-funding-ma-report-storage/

To learn more about the smart grid report, visit: https://mercomcapital.com/product/annual-q4-2025-funding-ma-report-grid/