Energy Storage Funding Declines in 1H 2025

Funding decreased by 41% due to policy uncertainties

August 13, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

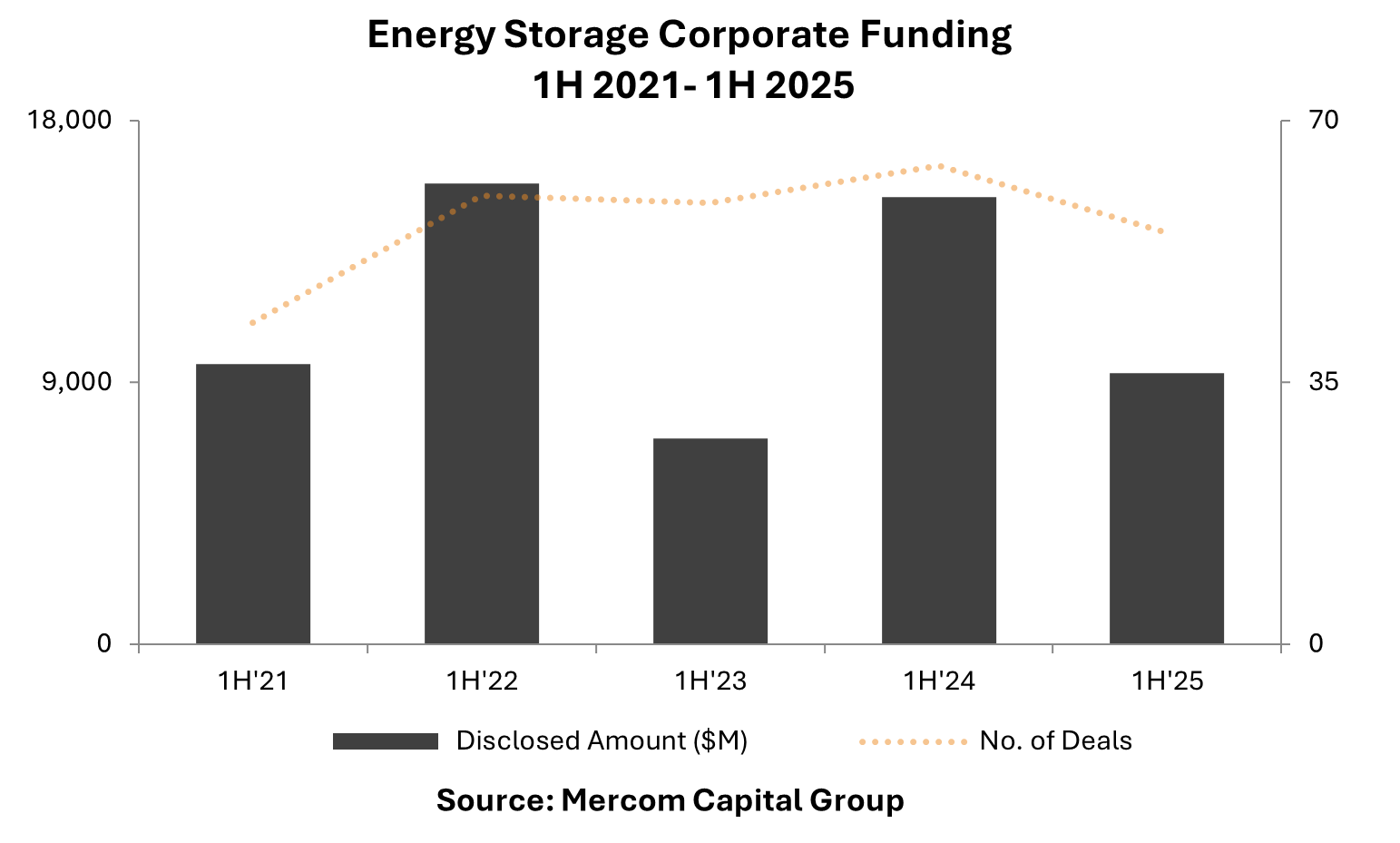

Corporate funding for energy storage companies fell sharply in the first half (1H) of 2025 to $9.1 billion across 55 deals, according to Mercom Capital Group’s 1H and Q2 2025 Funding and M&A Report for Energy Storage.

This represents a 41% year-over-year (YoY) decline from $15.4 billion, resulting from 64 deals, in the same period of 2024.

The downturn was attributed to the uncertainty surrounding multiple policy and tariff changes in the U.S., including proposed cuts to the Investment Tax Credit and several provisions of the Inflation Reduction Act.

Raj Prabhu, CEO at Mercom Capital Group, stated, “This uncertainty led to a slowdown in deal closures as the market adopted a ‘wait-and-see’ approach. Once the bill was finalized, even with some unfavorable provisions, the resulting policy clarity is expected to restore investor confidence in the second half of the year.”

The venture capital (VC) funding for energy storage companies in 1H of 2025 totaled $1.7 billion across 36 deals, representing a 29% decrease from the $2.4 billion invested in 48 deals during the same period in 2024. Energy storage downstream companies attracted the largest share of VC funding, followed by companies in materials and components, energy storage systems, sodium-based batteries, and thermal energy storage segments.

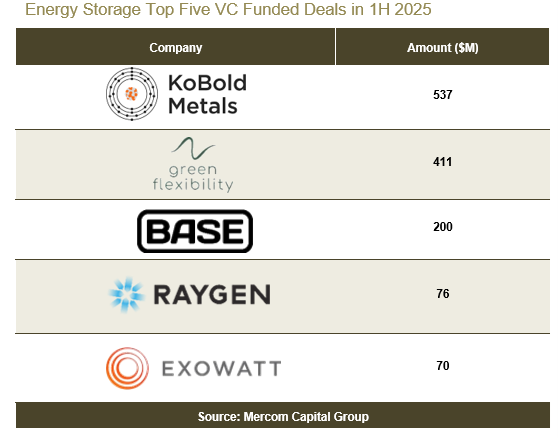

The top five VC transactions included KoBold Metals raising $537 million, Green Flexibility securing $411 million, Base Power receiving $200 million, RayGen Resources raising $76 million, and Exowatt bringing in $70 million.

Announced debt and public market financing for energy storage companies reached $7.4 billion in 19 deals in 1H 2025, a 43% decline compared to $13 billion in 16 deals in 1H 2024.

Mergers and acquisitions (M&A) activity in the energy storage sector also slowed, with only three corporate transactions recorded in the first half of 2025 compared to 14 in the same period last year.

However, M&A activity for energy storage projects increased sharply, with 31 project-related transactions in 1H 2025, representing a 138% increase from 13 transactions in 1H 2024.

The report highlights how regulatory developments and trade-related policy shifts significantly influenced investment flows and deal activity in the energy storage market.

Prabhu noted that advanced-stage projects, those licensed, permitted, under construction, or nearing completion, were in high demand. “Even during a period of uncertainty, buyers saw opportunities,” he said. He pointed out that some projects were acquired at more favorable valuations due to market conditions.

Despite the weaker first half, Prabhu stated that energy storage fared relatively well in the final legislation, with tax credits for storage installations preserved. This contrasted with solar and wind, which saw greater adverse policy impacts. “Now that policy direction is settled, the second half should see stronger performance than in the past two to three quarters.”

Smart Grid

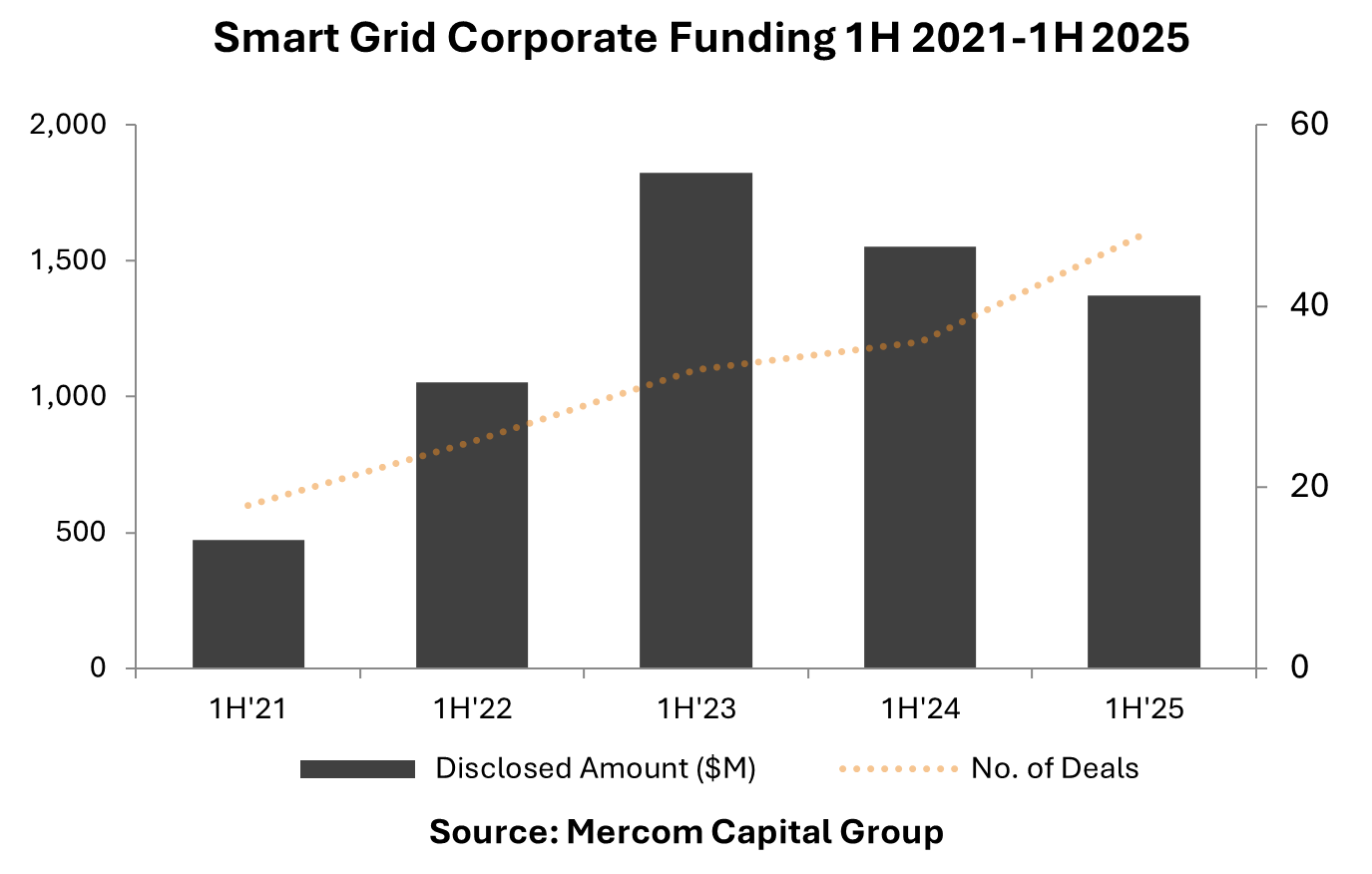

Corporate funding for global smart grid companies in the first half of 2025 totaled $1.4 billion across 48 deals, according to Mercom Capital Group’s 1H and Q2 2025 Funding and M&A Report for Smart Grid.

This represents a 13% decline compared to the $1.6 billion raised in 36 deals during the same period in 2024.

Substantial investments in smart charging companies supported the funding performance in 1H 2025. VC funding across all smart grid companies was $1.1 billion in 41 deals, an 8% YoY decrease from the $1.2 billion raised in 29 deals.

Prabhu said the smart grid sector managed to avoid a steeper decline seen in other clean energy segments. “Smart grid funding has been driven largely by investments in smart charging technologies, a trend that continued this quarter,” he explained.

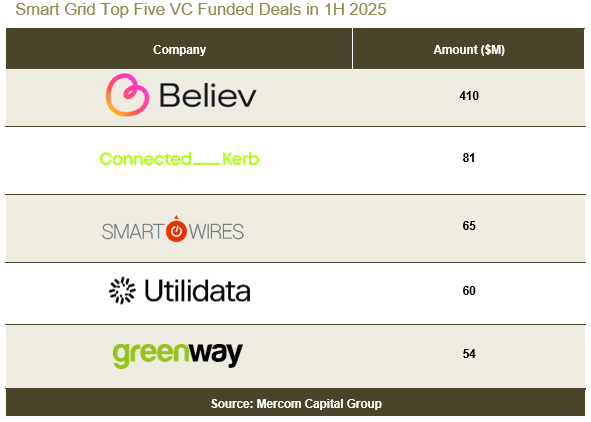

The top five VC funding deals in the smart grid segment during 1H 2025 were led by Believ with $410 million, followed by Connected Kerb with $81 million, Smart Wires with $65 million, Utilidata with $60 million, and GreenWay with $54 million.

“Funding flowed into grid and infrastructure technologies, which are essential to handle the intermittency of growing solar and wind installations. The critical need for grid optimization technologies helped sustain investors in the smart grid sector,” Prabhu said.

Debt and public market financing for smart grid technology companies in 1H 2025 totaled $300 million through seven deals, a slight decrease from the $321 million raised in the same number of deals during 1H 2024.

The M&A activity in the smart grid sector also saw changes compared to the previous year. In 1H 2025, there were four smart grid M&A transactions, with one transaction having disclosed financial details. In comparison, 1H 2024 recorded three M&A deals, all of which were undisclosed in value.

To learn more about the energy storage report, visit: https://mercomcapital.com/product/1h-2025-funding-ma-report-energy-storage/

To learn more about the smart grid report, visit: https://mercomcapital.com/product/1h-2025-funding-ma-report-smart-grid/