Energy Storage Attracts $2.8 Billion in Venture Capital in 9M 2025

VC funding for energy storage grew 4% during the period

November 4, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

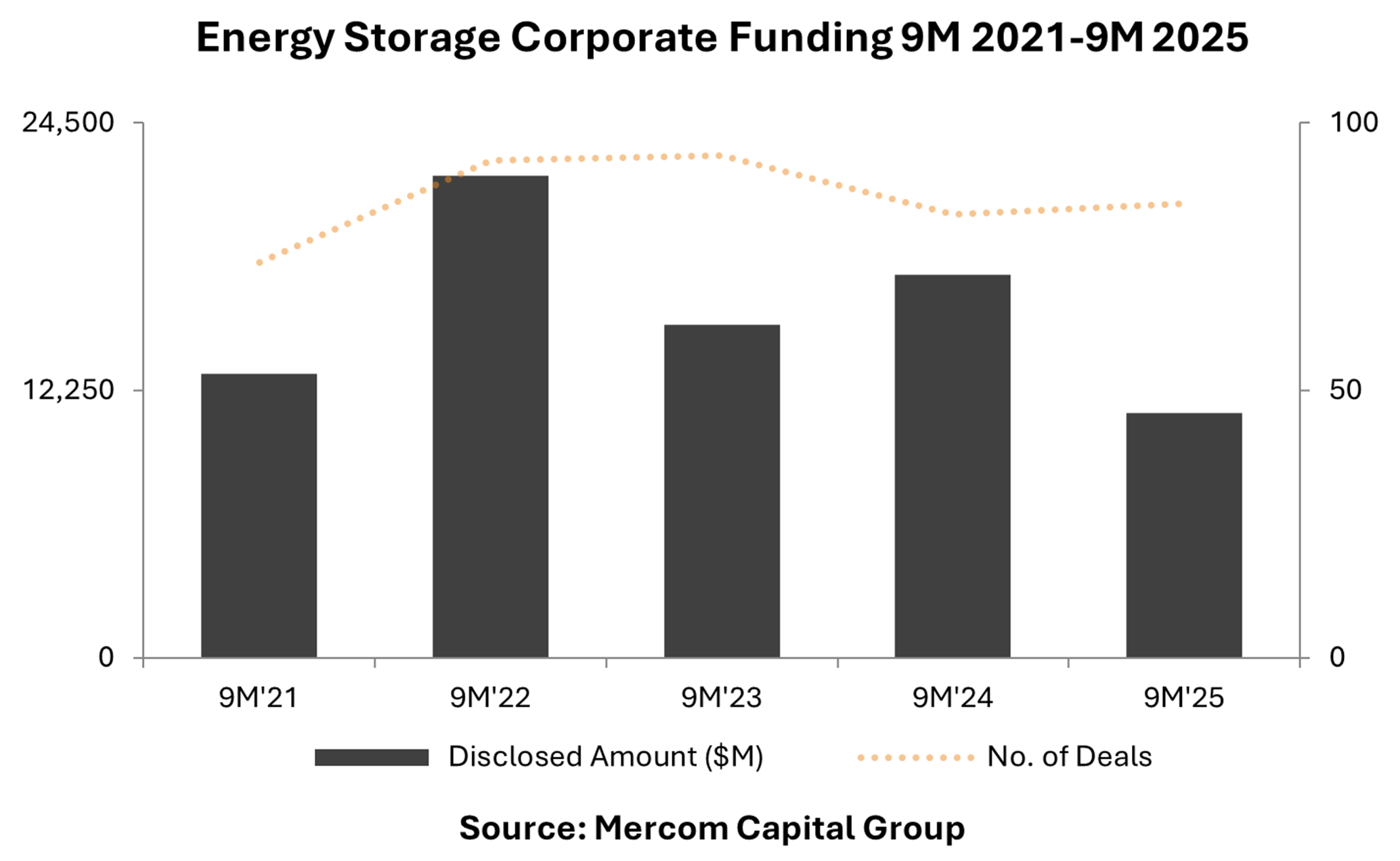

Corporate funding for energy storage companies came in at $11.2 billion across 85 deals in the first nine months (9M) of 2025, down 36% year-over-year (YoY) from $17.6 billion across 83 deals, according to Mercom Capital Group’s 9M and Q3 2025 Funding and M&A Report for Energy Storage.

Comparing the figures for 9M 2024 and 9M 2025, Raj Prabhu, CEO of Mercom Capital Group, noted that two major multi-billion-dollar deals in 2024 contributed to the higher numbers, skewing the year-over-year comparison.

Additionally, one of the multi-billion-dollar deals last year involved a Sweden-based battery development and manufacturing company, Northvolt, which filed for Chapter 11 bankruptcy protection in the U.S. last year.

Venture capital (VC) funding for energy storage companies in 9M 2025 totaled $2.8 billion across 56 deals, increasing 4% from $2.7 billion across 61 deals in 9M 2024.

Commenting on the rise in VC funding, Prabhu said that energy storage was one of the few sectors unaffected by the Trump administration’s One Big Beautiful Bill (OBBB). The incentives and subsidies remained in place, giving the market and investors confidence to back energy storage companies with a sense of long-term stability and support.

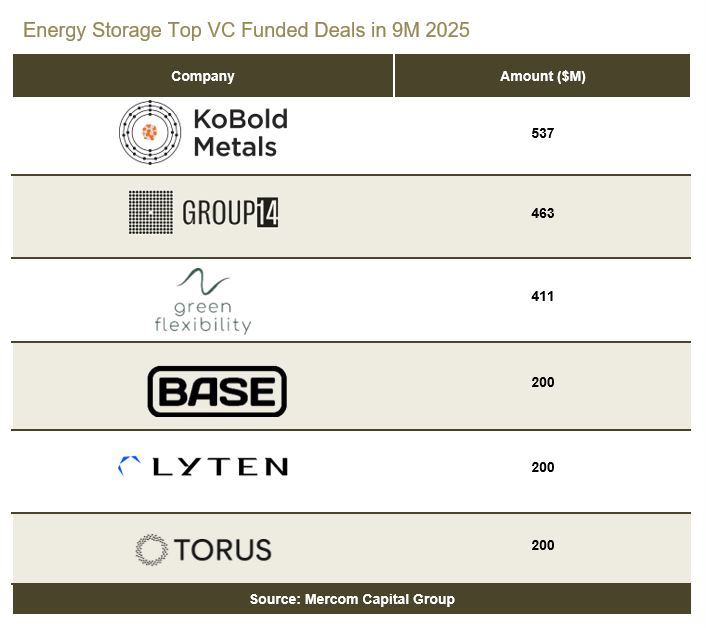

Companies in the materials and components segment were the highest beneficiaries of VC funding during this period, receiving $1.1 billion. They were followed by energy storage downstream companies, energy storage systems providers, and lithium and sodium-based battery companies.

The top VC funding recipients were KoBold Metals with $537 million, Group14 Technologies with $463 million, Green Flexibility with $411 million, and Base Power, Lyten, and Torus, each raising $200 million.

Prabhu is optimistic about the overall funding landscape in the energy storage sector, stating that market signals are positive for this segment.

“Without speculating on the actual figures, the number of deals is expected to grow,” he said. “Most of the uncertainty is now behind us. While there are still a few details the government needs to clarify, the existing subsidies and incentives remain strong. In addition, the U.S. Federal Reserve’s recent quarter-point rate cut, bringing rates down by half a percentage point this year, has also been a positive factor.”

However, Prabhu emphasized that “regulators should stay out of the way and avoid creating confusion or uncertainty, and the markets will take care of themselves.”

Announced debt and public market financing for energy storage technology companies stood at $8.4 billion across 29 deals in 9M 2025, decreasing 44% YoY from $15 billion across 22 deals.

In contrast, energy storage merger and acquisition (M&A) transactions increased to 20 in 9M 2025, up from 18 in 9M 2024. This period witnessed 45 announced project M&A transactions involving energy storage companies, compared to 22 during the same duration in the previous year.

“M&A activity has remained consistently strong in both solar and storage,” Prabhu said. He noted that there was considerable uncertainty in the U.S. earlier in the year, particularly in Q1, as the new administration was taking office. However, once the administration announced the OBBB and provided clarity on its details, confidence returned to the market.

“There were numerous deals in Q1, with attractive discounts on companies and projects, and favorable valuations for acquisitions due to the earlier uncertainty. The OBBB’s announcement helped clear things up and gave a strong boost to M&A activity,” he added.

Smart Grid

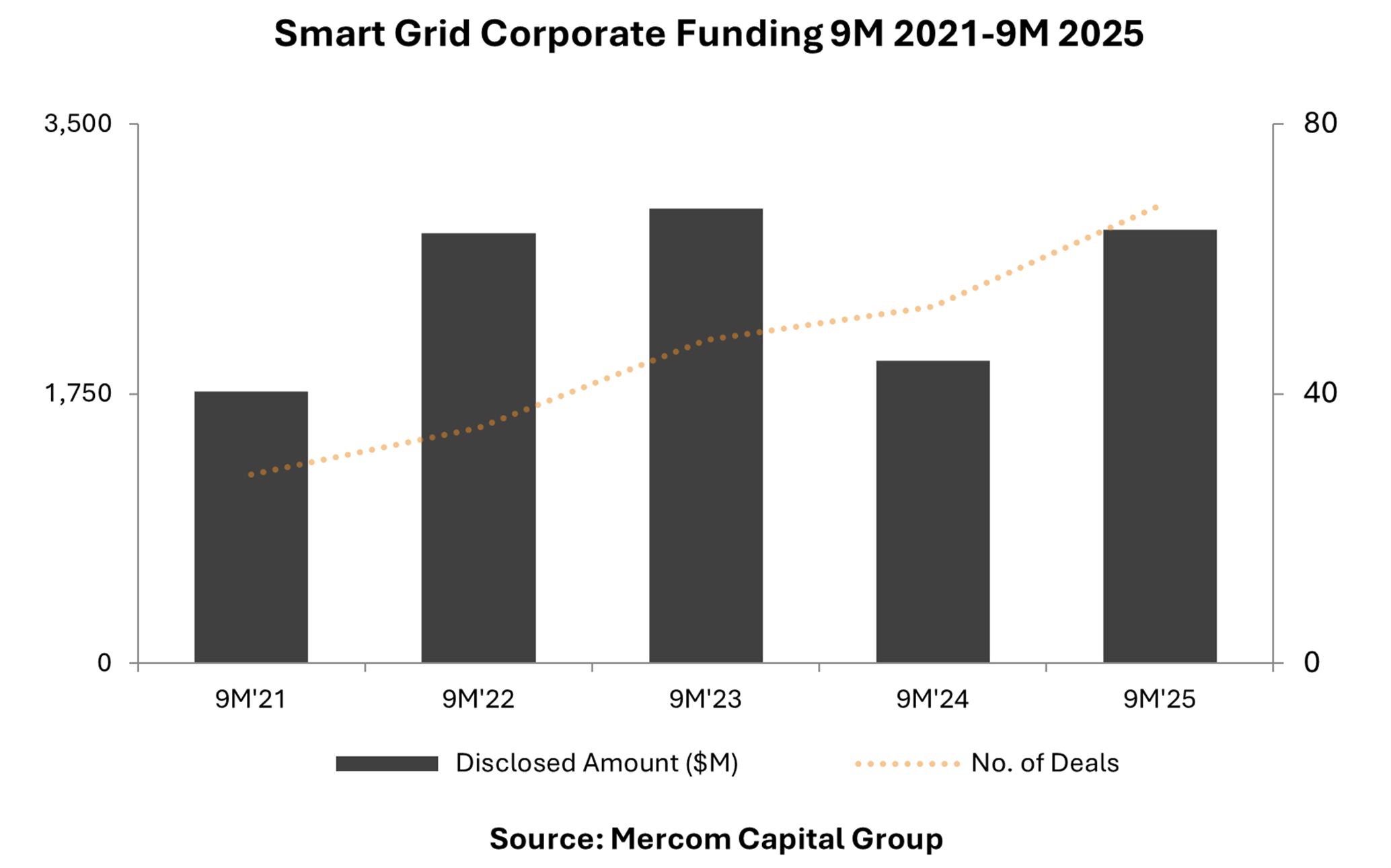

Corporate funding for Smart Grid companies in 9M 2025 reached $2.8 billion in 68 deals, 40% higher YoY from $2 billion in 53 deals, according to Mercom Capital Group’s 9M and Q3 2025 Funding and M&A Report for Smart Grid.

VC funding for smart grid companies in 9M 2025 totaled $1.6 billion across 55 deals, a 14% YoY increase from $1.4 billion across 43 deals.

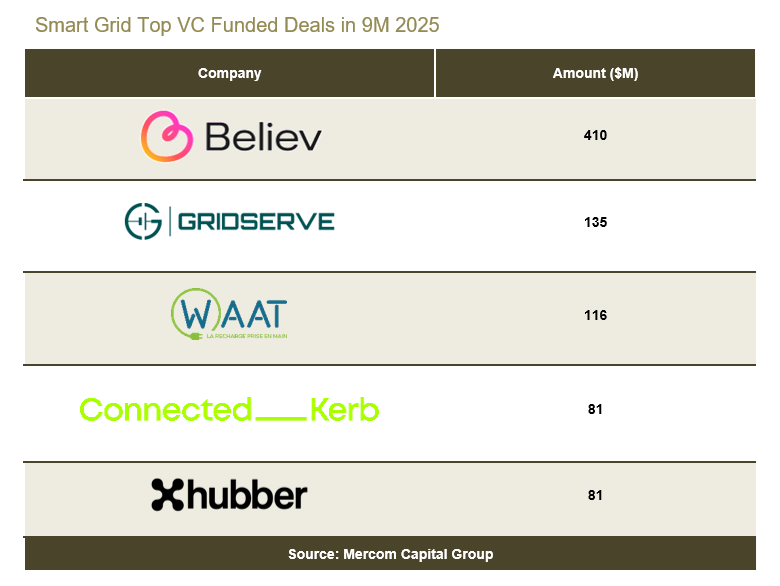

Smart charging companies were the biggest recipients of VC funding during the year, raising $1.1 billion. According to Prabhu, these companies were the main drivers of investment in the smart grid segment. “We need charging infrastructure globally and in the U.S. to support the growing number of electric vehicles on the road. This funding has continued even with the Trump administration’s cuts to EV incentives. Charging infrastructure is essential because it is still not as robust as the network of gas stations,” he said.

Prabhu added that another factor driving funding growth in smart grid companies is the growing challenge of grid stability as more energy storage and renewable generation come online. “Technologies that address these issues, such as demand response, grid optimization, and energy management, are becoming increasingly attractive to investors because of their role in maintaining grid balance,” he said.

Funding for smart charging corporations was followed by investment in companies in the grid optimization, distributed generation and integration, data analytics, and demand response sectors.

The top smart grid VC funding deals in 9M 2025 were Believ, which raised $410 million; GRIDSERVE, which raised $135 million; WAAT, which raised $116 million; and Connected Kerb and Hubber, each raising $81 million.

Announced debt and public market financing for the smart grid technology companies totaled $1.25 billion across 13 deals, increasing 120% YoY from $568 million in 10 deals.

A total of eight smart grid M&A transactions were announced in 9M 2025, compared to seven in 9M 2024.

The report on funding for energy storage companies is 78 pages long. To get a copy, visit:

https://mercomcapital.com/product/9m-and-q3-2025-funding-and-ma-report-for-storage/

To learn more about the smart grid report, visit: https://mercomcapital.com/product/9m-and-q3-2025-funding-and-ma-report-for-smartgrid/