Electricity Derivatives: A Gamechanger for Indian Power Market Stakeholders

Derivatives can reduce price volatility and stabilize power markets

July 16, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

The recent launch of electricity derivatives by the Multi Commodity Exchange of India (MCX) and the National Stock Exchange (NSE) is a long-awaited reform, with a history spanning over 15 years.

In 2010, an attempt to launch electricity derivatives led to a significant legal dispute between key regulatory bodies, the Central Electricity Regulatory Commission (CERC) and the Securities and Exchange Board of India (SEBI). Consequently, the CERC’s Power Market Regulations 2010 completely prohibited the use of financial derivatives. The primary reason for this was that power sector reforms were in their early stages, and with electricity being an essential commodity, policymakers were cautious about potential misadventures in such a market.

However, times have significantly changed. Both regulators reached a consensus in 2020, and further approval from the Supreme Court in 2021 paved the way for the introduction of electricity derivatives.

The current outcome is that any contracts involving the physical delivery of electricity will be regulated by CERC, while all other contracts will be regulated by SEBI.

The launch of electricity derivatives is an important initiative for power sector stakeholders, including independent power producers, distribution companies, and bulk electricity offtakers.

Before we delve into use cases, let’s understand two very important parameters of electricity markets:

- Electricity is simply the movement of electrons. It cannot be stored (unless very expensive storage is involved), hoarded, or stockpiled. Hence, electricity prices are purely a function of demand and supply on a 15-minute block basis. This is the only commodity where speculation or price manipulation is extraordinarily difficult.

- Electricity prices in India are subject to unprecedented volatility. While electricity prices in markets are highly subdued during solar hours (generally in the range of ₹2 (~$0.023)/kWh-₹3 (~$0.035)/kWh, prices can touch peaks (even as high as ₹8 (~$0.093)/kWh-₹10 (~$0.12)/kWh on the same day during peak timings or even at night nowadays. Such volatility in an essential commodity is highly undesirable.

Electricity derivatives provide a very important instrument to counter this volatility. For example, when financial investors are able to square off their position at a higher rate based on the 24-hour cycle, they will be willing to pay a high price for electricity derivatives during solar hours, effectively lifting the price of physical power during those hours.

Similarly, during peak times, when they are squaring off their positions for a profit, they will be willing to sell the contract at a lower rate than physical power, which will bring down the price during peak hours.

Accordingly, when derivative markets are deep enough, it will significantly impact physical power prices, ultimately benefiting the sector.

With this understanding, let’s look at broad use cases for various stakeholders in the electricity markets:

Independent Power Producers (IPPs)

For many years, IPPs have been exploring ways to finance merchant projects. However, financing for such projects is difficult as lenders are concerned about long-term revenue visibility (given price volatility). Many bulk electricity offtakers with net-zero targets have similar concerns.

Recently, CERC issued draft guidelines for the Virtual Power Purchase Framework. These contracts essentially shift (partially or fully) the market risk for sustainability offtakers. Electricity derivatives provide them with a much-needed instrument to hedge their market positions.

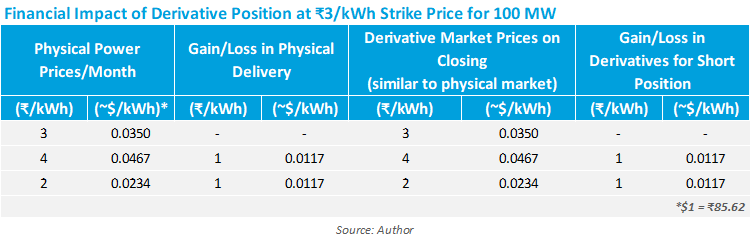

For example, say a sustainability offtaker executes a VPPA for 100 MW at a strike price of ₹3 (~$0.035)/kWh. With electricity derivatives, the offtaker can essentially hedge the entire market risk by taking a short position for 100 MW in derivatives at ₹3 (~$0.035)/kWh.

The following table illustrates the broad framework for such a transaction:

By taking the opposite position in the derivative market, an IPP or offtaker is essentially able to nullify any market risks in the contract.

Distribution Companies (DISCOMs)

DISCOMs act as both sellers and buyers in physical power markets; however, they are price takers without any ability to influence the price. Especially during solar hours, most DISCOMs offload electricity at whatever prices the market is willing to pay, and then become net buyers during peak and nighttime hours.

This results in significant losses to the public as the cost is passed through to ordinary electricity users.

However, with electricity derivatives, DISCOMs may enter into block deals with a financial investor to mitigate price risks. For instance, a DISCOM has a surplus of 100 MW during the daytime, which it intends to sell at ₹3 (~$0.035)/kWh, and becomes a net purchaser of 100 MW during peak time, which it intends to purchase at ₹6 (~$0.070/kWh. Simultaneously, a financial investor believes that daytime power should be ₹3.50 (~$0.041)/kWh and peak time power should be ₹5.50 (~$0.064)/kWh. This DISCOM may enter into a block deal for an equivalent amount of derivatives, for instance, at a rate of ₹3.25 (~$0.038)/kWh during the daytime and ₹5.75 (~$0.067)/kWh during peak time. This will enable both parties to gain ₹0.25 (~$0.0029/kWh.

Bulk Electricity Offtakers

Currently, most bulk electricity offtakers face a significant challenge in obtaining visibility into electricity volume clearance when purchasing electricity from exchanges. While bid or breakeven prices are known, volume clearances are subject to demand and supply during each 15-minute block. When the price discovered is higher than the bid price, volumes are not cleared, and the offtaker purchases the shortfall quantity from the DISCOM. If the price discovered is lower than the bid price, the difference is the net profit for the offtaker.

Using financial derivatives, bulk electricity offtakers may largely target monthly savings. They can take a buy position based on uncleared volume from the start of the month, with the premise that notional losses for uncleared volume are made good through profits made in the derivative market. The above provides a broad overview of the potential uses of derivatives. As the derivatives market deepens, a new wave of innovations is likely to drive the development of many new products. These innovations ultimately reduce price volatility and provide a stable market framework for all stakeholders in the sector.

The views and analysis presented in this article are solely those of the author.

(The author Aditya Malpani is Senior Director & Regional Head – West, AMPIN Energy Transition)