Corporate Solar Funding Declines 39% YoY Amid Policy Uncertainties

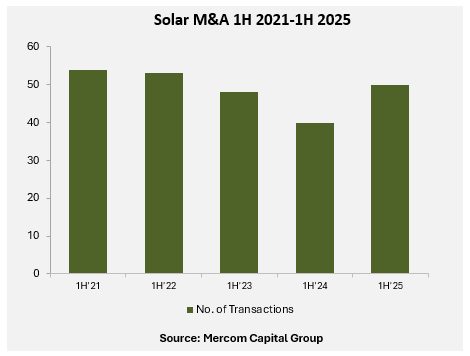

Solar M&A transactions rose to 50 in 1H 2025, compared to 40 in 1H 2024

July 18, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

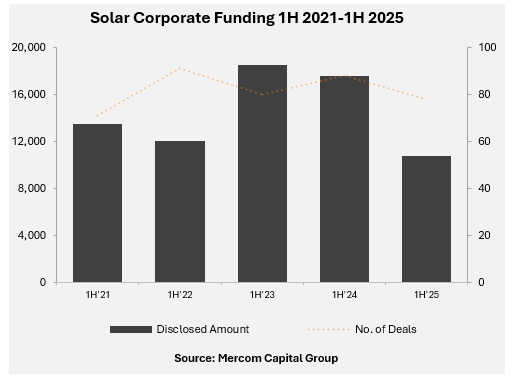

Total global corporate funding for the solar sector dropped by 39% year-over-year (YoY) to $10.8 billion in the first half (1H) of 2025 from $17.6 billion, according to Mercom India’s newly released 1H and Q2 2025 Solar Funding and M&A Report.

The number of deals also decreased by 11% to 78 deals from 88 during the same period last year.

Raj Prabhu, CEO at Mercom Capital Group, attributed the decline in global corporate funding in the solar sector to the market freeze due to uncertainty over the ‘One Big Beautiful Bill.’

“This was the first full quarter under the Trump administration, and from the outset, it was clear that changes were coming to the Inflation Reduction Act and the Investment Tax Credit (ITC). The draft legislation released by Congress initially caused significant concern in the solar industry. When the bill went to the Senate, it improved slightly. However, when the President signed the bill, it was clear that the legislation would not be favorable for the solar sector. During this period of uncertainty, financial activity slowed down,” Prabhu said.

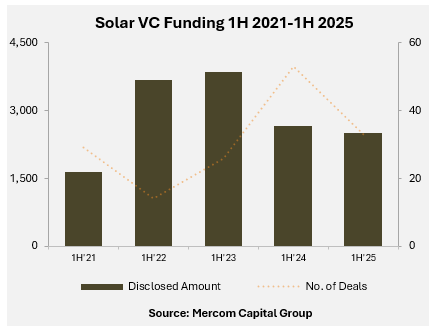

Global venture capital (VC) funding amounted to $2.5 billion from 32 deals in 1H, decreasing 7% YoY from $2.7 billion from 29 deals.

In the second quarter (Q2) of 2025, global VC funding activity declined by 50%, with $1.1 billion raised across 18 deals, compared to $2.2 billion raised across 16 deals in Q2 2024.

Prabhu explained that markets have been in a state of flux since last November due to the change in administration and the anticipation of a policy shift for solar energy.

“The market has been in a downturn since the U.S. elections last November. There was a constant fear that the new administration would not be favorable to solar, and the bill confirmed this fear. This uncertainty has led to slowing down of the markets,” he said.

Solar downstream companies led financing activity with 25 deals worth $2.2 billion in 1H 2025.

The top VC deals in 1H 2025 were $1 billion raised by Origis Energy, $500 million raised by Silicon Ranch, $130 million raised by Terabase Energy, $129 million raised by Enpal, and $111 million raised by Solveo Energies.

A total of 86 VC investors participated in solar funding in 1H 2025.

Solar public market financing during the period totaled $467 million across five deals, representing a 73% decrease from $1.7 billion across eight deals in 1H 2024.

Solar debt financing activity decreased by 41% YoY to $7.8 billion across 41 deals, compared to $13.2 billion raised in 51 deals in the same period the previous year.

There were four securitization deals in 1H 2025, totaling $1.6 billion, a 47% decrease YoY from $3 billion raised in nine deals.

The first half of 2025 witnessed 50 solar mergers and acquisitions (M&A) transactions, compared to 40 in 1H 2024.

The largest acquisition deal was made by ONGC NTPC Green, a joint venture between ONGC Green and NTPC Green Energy, which signed a share purchase agreement for $2.3 billion to acquire a 100% equity stake in the utility-scale renewable energy platform, Ayana Renewable Power.

Prabhu noted that the M&A activity had increased despite a decline in corporate funding for the sector, which was surprising. “Both corporate and project M&A were up during this quarter. During periods of uncertainty, whether in the stock market or the industry, there are pockets of opportunity to acquire undervalued companies or assets which is happened.”

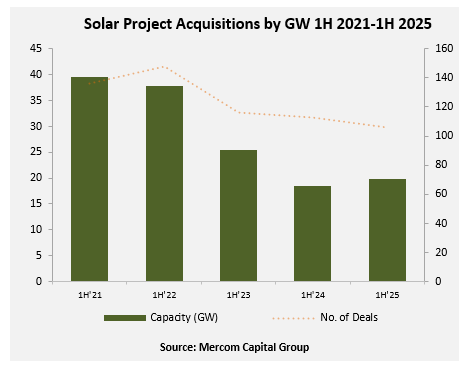

In 1H 2025, 106 solar project acquisitions totaling 19.9 GW took place, compared to 113 project acquisitions totaling 18.5 GW in 1H 2024.

Prabhu stated that most of the projects being acquired were in advanced stages, and relatively few early-stage projects were acquired.

Investment firms acquired most of the solar projects in Q2 2025, picking up 2.1 GW, followed by oil and gas companies with 1.53 GW. Project developers and independent power purchasers acquired 1.5 GW of projects.

Other companies (insurance providers, pension funds, energy trading companies, industrial conglomerates, and information technology firms) followed with 1 GW, and utilities with 136 MW.

However, Prabhu added that the market situation could change in the second half of the year with investors having a clearer view of the policies.

“Now that the bill has passed, the period of uncertainty is over. For the first time since the Trump administration took office, we have visibility into the complete policy landscape. However, the bill itself is not good news for the solar sector. The ITC will phase out faster than expected, except for energy storage. Markets now have a clearer view, but will need to adjust quickly in real-time. The business models will have to change to adapt to the new policy environment. Even though the entire funding scenario may not revert, some parts of the sector may rebound better than others. This clarity in the policy landscape will drive the financial activity,” he added.

This report covers 339 companies and investors. It is 106 pages long and contains 88 charts, graphs, and tables.

To download the complete report, visit: 1H and Q2 2025 Solar Funding and M&A Report – Mercom Capital Group