China’s Solar Manufacturing Capacity Expands by 1,500 GW

The expansion amounted to a total of ~$13.89 billion during 1H 2023

July 18, 2023

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

As the price of polysilicon materials dropped by almost 50% during the first half (1H) of 2023, solar manufacturers in China have scaled up expansion plans with silicon wafers/rods/slices reaching 442 GW, silicon materials reaching 760,000 tons and solar modules and batteries together approaching 1,100 GW during the period.

The total expansion would amount to a total of ¥100 billion (~$13.89 billion), as reported by China’s Solar Photovoltaic Portal – Polaris Solar Photovoltaic Network.

Polysilicon

Investments in polysilicon witnessed a dip during 1H. Polysilicon production amounted to 760,000 tons compared to the 1.37 million tons achieved during the same period last year. The investment also saw a 55.47% YoY drop.

The drop in polysilicon prices is due to the over-expansion of production capacity over the last two years following a severe polysilicon supply crunch.

According to Polaris Solar Photovoltaic Network, only six companies across the country – Hoshine Silicon, Lihao Semiconductor, Tongwei, Runyang Yueda, Shangji CNC, and Runxiang Quartz Mining — announced expansion plans with a total investment of more than ¥10 billion (~$1.39 billion).

![]()

Wafers

According to the Polaris Solar Photovoltaic Network’s statistics, silicon wafer production reached 442 GW from January to June and was worth ¥41 billion (~$5.7 billion).

Some of the major announcements during 1H 2023 include LONGi Green Energy’s announcement to expand its production capacity to 100 GW in Xixian New District, Shaanxi, and TCL Zhonghuan augmentation of its silicon wafer production capacity to 35 GW in Yinchuan, Ningxia, and Guangzhou.

In January, JA Solar unveiled plans to expand its vertically integrated production capacity to 20 GW of silicon wafers and 20 GW of crystal pulling capacity with a total investment of ¥40 billion (~$5.56 billion). In June, the company expanded its Inner Mongolia Ordos facility to manufacture 30 GW of crystal pulling and 10 GW of silicon wafers.

Jinko raised ¥10 billion (~$1.39 billion) for its expansion plan for a 10 GW engineering project in the first phase of the 20 GW rod-cutting project.

Canadian Solar also revealed its plan to expand the silicon wafer and cell production capacity by 14 GW in Yangzhou.

Several new players also announced investments to expand production capacities across the country.

The report notes two noticeable trends across all expansion plans – first, the expansion of N-type silicon wafers, and second, the new requirements for thinning of silicon wafers and the layout of ultra-thin silicon wafers with the increased demand for N-type cell technology.

For the N-type layout, companies like Huamin and Daheng Energy have announced a total of 41 GW of silicon wafer expansions.

TCL Zhonghuan has reduced the thickness of its N-type silicon wafers to 110 μm from 130 μm. Similarly, Gaoce has started the mass production of 210 mm and 110 μm silicon wafers. The company is said to have achieved 60 μm flakes during its research and development breakthroughs.

The Polaris Solar Photovoltaic Network foresees a collision between the old and the new silicon wafer manufacturers in the Chinese solar market as the prices continue to drop.

The price for LONGi silicon wafers continued to drop for two consecutive months, and the latest price of a monocrystalline P-type M10 silicon wafer is ¥2.93 (~$0.41) per piece, which is 53.12% lower than what it was at the start of the year.

The price for the latest P-type 150um 218.2mm silicon wafer from Zhonghuan has dropped by 34.69%, and the price for N-type 130um 210mm silicon wafers has dropped by 34.73% since January 2023.

Cells & Other Components

With the transition of technology from P-type to N-type, cell and module companies now have three new technologies to choose from – Tunnel Oxide Passivated Contact (TOPCon), Heterojunction technology (HJT), and Interdigitated Back Contact (IBC).

According to the Polaris Solar Photovoltaic Network statistics, the total scale of cell and module production expansion has reached 1,100.6 GW in 1H 2023, compared to 475.1 GW last year.

The cell sector expansion alone accounts for 65.3% of the total capacity.

The TOPCon technology has witnessed the fastest growth rate, accounting for 21.84% of the total expansion. While HJT, after being dropped by multiple manufacturers as a unviable technology, accounted for only 10.23%, and Hybrid Passivated Back contact Cell (HPBC), a product of IBC technology, accounted for 1.99%.

LONGi’s cell production expansion scale reached 100 GW during 1H 2023, and the module production scale expanded to 10 GW. JA Solar expanded the production capacity to 70 GW cells and 25 GW components, while Jinko expanded the production capacity to 11 GW of cells and 15 GW components, which included a high-efficiency cell project with a 10 GW capacity.

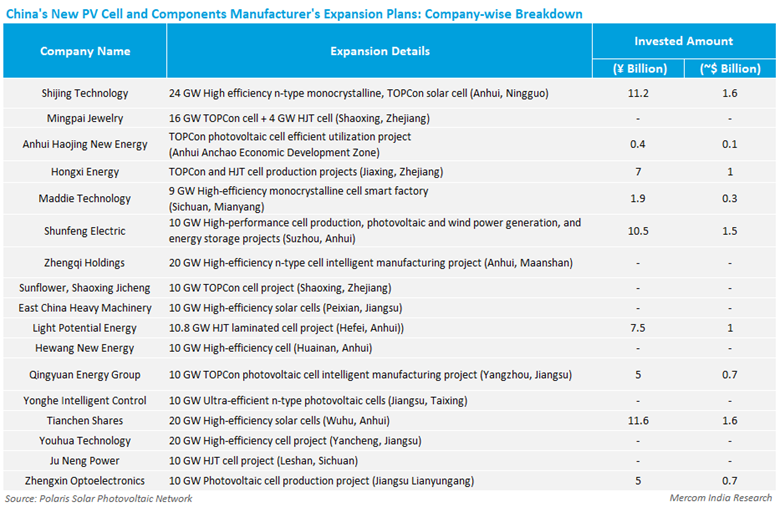

The Polaris Solar Photovoltaic Network also highlights several new players in China who have announced ambitious expansion plans.

While the expansion plans are seen as progress in the solar photovoltaic industry in China, Polaris notes that the excess production will inevitably lead to over half of the companies shutting shop over time.

According to China Photovoltaic Industry Association, the country’s annual export of polysilicon wafers, cells, and modules, surpassed $51 billion in 2022, a year-over-year increase of 80.3% despite the import barriers erected by several countries to restrict the entry of Chinese products last year.

Mercom recently reported on the price drop of Chinese modules during the first quarter and its impact on the Indian solar manufacturing sector.