China’s Dominance in Critical Minerals Supply and Refining Continues: IEA

Recent price and investment trends severely impacted efforts to diversify supply

May 28, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

China was the key supplier of battery metals, including lithium, nickel, cobalt, and graphite, in 2024, according to the Global Critical Minerals Outlook 2025 report by the International Energy Agency (IEA).

Demand for key energy minerals continued to grow strongly, with lithium demand rising by 30% and nickel, cobalt, graphite, and rare earths growing by 6% to 8% in 2024.

The average market share of the top three refining nations of key energy minerals rose from around 82% in 2020 to 86% in 2024. Approximately 90% of supply growth came from the top supplier nations: Indonesia for nickel and China for cobalt, graphite, and rare earths.

Energy applications, including electric vehicles, battery storage, renewable energy, and grid networks, largely drove this growth.

However, supply increases, driven by China, Indonesia, and parts of Africa, outpaced the demand growth. Given the relatively small supply base, the rapid expansion of mined output for battery metals demonstrated the sector’s ability to bring new production online faster than traditional metals.

The production growth outpacing demand resulted in prices for key energy minerals remaining subdued in 2024.

This development was particularly true for battery metals. Since 2023, lithium prices have plummeted by over 80% after skyrocketing eightfold in the previous two years. Throughout 2024, graphite and cobalt prices decreased by approximately 20%, and nickel prices fell by 10%. However, these declines were less pronounced than in 2023.

According to the report, some base metal prices saw a slight increase, while the process for many others continued to decline because of supply growth outpacing demand.

China remains the dominant supplier of all key refined critical minerals, both in terms of geography and ownership. It also retained the largest demand for all key critical refined minerals. The country accounts for over half of the global demand for copper, lithium, nickel, cobalt, graphite, and magnet rare earth elements.

In 2024, copper and nickel were the only refined minerals for which China’s local demand exceeded domestic supply. However, Chinese firms own a significant portion of Indonesia’s refined nickel supply, leaving copper as the only refined mineral facing a domestic shortfall. China’s domestic production satisfies only 75% of its consumption for this metal.

In contrast, China has the largest domestic supply surplus of battery-grade graphite and rare earth elements used in magnets. Therefore, other countries rely considerably on China for refined supply.

Critical Mineral Refining

Recent price and investment trends severely impacted efforts to diversify supply, particularly for refined materials.

The report said that between 2020 and 2024, China, the leading refiner of copper and lithium, accounted for approximately 70% to 80% of supply growth for these minerals, while Indonesia, the top nickel refiner, contributed roughly 90%.

China drove nearly all production growth for cobalt, graphite, and rare earth elements, further sidelining emerging producers in geographically diverse regions.

The country not only dominates critical mineral refining in terms of geography but also in terms of ownership. Under both categories, China produces over 95% of battery-grade graphite and rare earths.

Australian company Lynas is one of the only major players in the rare earths sector outside China. It represented 4% of global refined production in 2024 from its operations in Malaysia. The U.S. accounted for 1% of the global refined production.

China produces approximately 70% of the world’s lithium chemicals by geographic location and ownership and over 40% of the world’s copper.

Battery Pack Price Trends

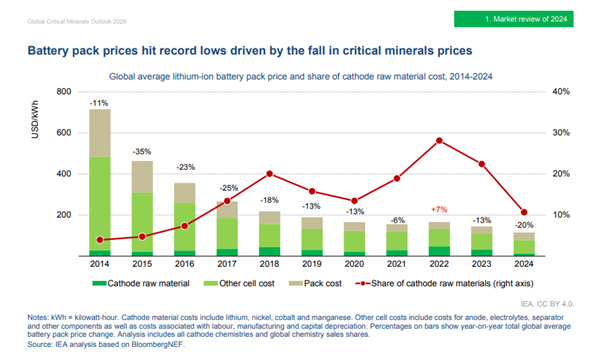

In 2024, the average battery pack prices fell by 20% to a record low of $115/kWh, the largest annual drop since 2017.

This decrease was primarily driven by falling critical mineral prices, with the share of cathode raw materials in the total battery pack price dropping to just over 10% – its lowest level since 2016 – from over 20% in 2023.

Other reasons for reducing battery pack costs include sufficient cell manufacturing capacity, benefits from economies of scale, an increase in lithium-iron-phosphate (LFP) battery adoption, and intense price competition among battery producers, especially in China.

In China, prices fell around 30% in 2024, compared to a 10% to 15% drop in the U.S. and Europe, increasing the competitive advantage for Chinese battery and electric vehicle producers.

According to BloombergNEF, lithium-ion battery pack prices dropped 20% from 2023 to a record low of $115/kWh in 2024, the most significant annual decline since 2017.

China retained its dominance over the midstream and downstream EV and storage battery supply chain in 2024, processing 70% to 95% of global lithium, cobalt, phosphate, and graphite. The country produced 98% of LFP and two-thirds of nickel-based cathode material, over 90% of anode material, and 80% of global battery cells. Indonesia increased its upstream nickel production share, supplying 60% of mined nickel and processing almost 45%.

Renewables Surge Continues

In 2024, global annual renewable capacity additions surged by an estimated 25%, rising to around 700 GW. Solar accounted for over three-quarters of the capacity additions, followed by wind with 17%.

Electricity generation from renewables contributed almost three-quarters of the global increase in 2024.

China again led the global capacity expansions, accounting for nearly two-thirds of the total renewable capacity connected to the grid.

Solar additions during the year grew almost 30% from 2023, totaling about 550 GW. China’s solar capacity additions reached over 340 GW, up 30% from the previous year. The European Union (EU) installed approximately 60 GW of solar capacity.

For wind, annual additions remained stable compared to 2023 at approximately 120 GW. Electricity generation from wind expanded by roughly 180 TWh with new projects being brought online.

China installed 80 GW of wind capacity in 2024. Wind additions in the EU dropped by 20% despite wind energy accounting for 20% of all electricity consumed in the region.

The report expects robust growth in electric vehicle sales to continue, driven by increasing cost competitiveness.

Global electric car sales exceeded 17 million in 2024, a 25% year-over-year (YoY) increase. China remained the leading market, selling over 11 million electric cars.

In 2024, Europe remained the second-largest market for electric cars, with sales reaching 3.2 million vehicles, accounting for nearly 20% of the global total. Electric car sales in the U.S. rose to 1.6 million, rising 10% over 2023.

Outlook for Key Minerals

The report expects critical mineral demand to grow rapidly, driven by energy technologies.

Battery deployment in EVs and energy storage applications will drive strong demand growth for lithium, graphite, nickel, and cobalt.

The demand for cobalt and rare earth elements will also grow significantly, increasing 50% to 60% by 2040. Copper has the largest established market, with its demand projected to grow by 30% over the same period.

Cobalt demand has been affected by the growing LFP chemistries adoption, with projected 2040 demand now over 10% lower than last year’s outlook.

Under IEA’s base case, the combined market value of copper, lithium, nickel, cobalt, graphite, and rare earth elements is expected to increase by 50%, reaching $500 billion by 2040.

While copper maintains the largest share of the combined market value, lithium will experience the fastest growth, increasing fivefold by 2040. Under the high production case, both copper and lithium see notable supply shortfalls.