CERC Favors Grid Connectivity Only to Renewable Energy Projects with PPAs

As a second option, the CERC staff paper suggests connectivity allocations

November 26, 2025

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

A new staff paper by the Central Electricity Regulatory Commission (CERC) has suggested that grid connectivity for renewable energy projects be given only if they have signed power purchase agreements. As another option, it has been recommended that an auction regime be introduced for all connectivity allocations.

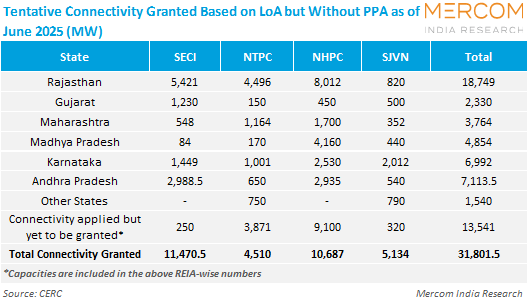

These suggestions have been made in the context of 31.8 GW of renewable energy projects that have secured tentative grid connectivity in the absence of power purchase agreements(PPA) as of June 2025.

When pending applications are included, this number climbs to nearly 45.3 GW, representing a very large block of connectivity that has not yet translated into firm offtake in India’s transition pipeline.

The staff paper suggests removing the letter of award (LoA) basis for eligibility altogether, allowing connectivity only when PPAs are already signed. LoAs alone do not demonstrate project certainty and therefore should not lock transmission resources.

The second is a larger system change under which all connectivity allocation would shift to auctions, replacing the LoA, land, and land plus bank guarantee routes. Such auctions would explicitly attach timelines and financial consequences, turning connectivity into a market mechanism rather than an administrative gate.

Under this model, developers would be required to achieve financial closure at least six months before the auction-linked commercial operation date and to submit land documents by the commercial operation date, with commercial operation date timelines set by the auction award itself.

What is Driving the Move

Under the general network access (GNA) framework, renewable energy generating stations and energy storage projects can obtain interstate transmission system connectivity through three routes. They can use a LoA or a signed PPA issued by a renewable energy implementing agency. They can also apply based on land availability or through a land-plus-bank-guarantee pathway, in which land is submitted later.

Under the land-plus-bank-guarantee route, developers initially submit a bank guarantee tied to capacity, i.e., ₹1 million (~$11,203)/MW up to 1,000 MW, and beyond that a bank guarantee of ₹1 billion (~$11.2 million) plus ₹500,000 (~$5,601)/MW for capacity over and above 1000 MW, with land documents allowed to be submitted later within the prescribed timelines.

The LoA route was meant to speed up early-stage project allocation. However, the staff paper notes that connectivity awarded purely on LoAs is increasingly getting stranded. Many developers hold connectivity for long periods while their PPAs remain unsigned. Since developers generally begin implementing projects only after securing PPAs, the allocated bays and transmission margins remain idle.

This has two system-wide consequences. First, transmission assets planned or already built for these projects remain underutilized, creating avoidable costs. Second, other ready projects are blocked from accessing available connectivity, forcing fresh transmission planning and delaying project timelines.

Stakeholder Suggestions

Renewable energy implementing agencies (REIA) have urged the regulator to allow developers a liability-free exit if PPAs are not signed within a year of LoA issuance. They also support reallocating relinquished connectivity through auctions, arguing that bidding would identify developers willing to commit to clear timelines and even pay for early access.

They suggest additional reuse pathways for stranded bays, such as allowing the same developer to back existing connectivity with another LoA/PPA from the same or a different implementing agency, or even a third-party offtaker, in cases where at least 50% of the required land is already secured, typically with a two-year commissioning window or up to GNA operationalisation, whichever is later

A joint committee of the Ministry of Power and the Ministry of New and Renewable Energy has suggested a structured window for older LoAs. For LoAs older than 12 months, the committee proposes a three-month period in which developers must either surrender connectivity without penalty or shift to a merchant mode pathway with reset timelines. If no choice is made, connectivity would be cancelled.

Moving to merchant mode would reset the scheduled commercial operation date to two years from the date the developer opts in, and the switch would be one-way, requiring a no-objection certificate from the concerned implementing agency if the developer later migrates to the land or land-plus-bank-guarantee routes. The committee’s rolling three-month window would operate in batches until the legacy LoA stock is exhausted.

The committee also allows limited swaps of LoA-linked connectivity within the same corporate group under specific conditions.

Proposal on LoA-based Connectivity

The staff paper lays out three options for projects that have held LoA-based connectivity for more than 12 months without signing a PPA. Developers must choose within one month of the decision taking effect. If no choice is made within this period, the connectivity will be treated as surrendered.

- Convert to land route and keep connectivity

Developers may exit the LoA route while retaining their allotted connectivity by shifting to the land-based pathway. This is positioned as a continuation option for serious developers whose PPAs were delayed for reasons beyond their control.

To use this option, the developer must apply within one month and submit a no-objection certificate from the concerned implementing agency confirming that the PPA was not signed. The earlier LoA becomes invalid for future connectivity claims.

Existing connectivity bank guarantees remain applicable, and a new performance bank guarantee of ₹1 million (~$11,203)/MW must be submitted. A new scheduled commercial operation date must be set within 18 months of the conversion date.

The developer must submit land documents within 12 months and achieve financial closure within 15 months. Delays on land or financial closure can be condoned only up to three months with milestone extension charges of ₹1,500 (~$17)/MW/day.

Commercial operation delays can be condoned only for up to six months, with milestone extension charges of ₹5,000 (~$56)/MW/day. Missing these deadlines would lead to the revocation of connectivity and encashment of the guarantees. If only part of the connectivity is converted, any remaining capacity not backed by land documents will be revoked in accordance with existing rules.

- Substitute with another LoA that has a signed PPA

This option targets cases where the same developer or corporate group has another LoA that has progressed to a signed PPA, but with a later commissioning schedule. The staff paper proposes a substitution so that a real PPA can back stranded connectivity holding.

The developer may replace the delayed LoA with another LoA that has a signed PPA, provided the firm start date of connectivity under the substituted PPA is at least six months later than the original LoA schedule.

Substitution can be allowed only where the connectivity and access configuration remain technically compatible, including solar or non-solar-hour access and storage-linked access, where relevant. If substitution uses a parent/subsidiary PPA within a corporate group, the original connectivity grantee retains full responsibility for compliance and any penalties.

The staff paper also notes that substitution should not be used to alter the approved access type for charging or drawal from the ISTS, except under the applicable GNA change provisions.

Financial closure must be achieved at least six months before the scheduled date under the substituted PPA or its firm start date, whichever is later. Failure to meet this requirement would trigger the revocation of connectivity and the encashment of the connectivity fee.

Where the substituted PPA capacity is smaller than the connectivity held, any excess bays or automatic transfer switch that cannot be backed down must be surrendered or shifted to the land-conversion route, and bank guarantees tied to any unawarded bays/ automatic transfer switch are to be treated under the staff’s surrender/return rules.

If the connectivity capacity exceeds the substituted PPA capacity, the excess must be surrendered or shifted via the conversion route.

This pathway is designed to avoid wasting connectivity where a developer has a genuine offtake elsewhere but faces timing mismatches across tenders.

- Surrender and auction the capacity

Developers may surrender stranded LoA-based connectivity within one month. In such cases, the Central Transmission Utility of India (CTUIL) would encash the first connectivity bank guarantee but return the second and third guarantees.

The surrendered capacity would be auctioned and allocated to new developers. The staff paper proposes CTUIL as the nodal agency, while auctions would be run through established bidding platforms used by implementing agencies or other approved entities.

The base auction price is set at ₹300,000 (~$3,361)/MW, reflecting the typical guarantee exposure for such connectivity. Bids would be called as a premium over this base price, and the highest premium would win.

Two timeline categories are proposed. If the relevant substation is already commissioned or expected to be commissioned within 12 months, the winning project must achieve commercial operation within 12 months. If substation commissioning is more than 12 months away, the project must be commissioned within 24 months or upon substation readiness, whichever is later.

The minimum bid size is 50 MW. An earnest money deposit equal to 5% of the base price bank guarantee would be required, and a performance guarantee equal to 10% of the base price bank guarantee would be required for winners.

A bid processing fee of ₹500,000 (~$5,601) plus taxes applies, winners must deposit the bid amount within three days of being declared successful, and the connectivity agreement must be signed within one month of the award.

Winning bidders must also submit required technical connection data and meet land and financial-closure milestones. If a winning bidder fails to sign the connectivity agreement within the deadline or does not furnish the performance guarantee on time, the earnest money deposit is encashed, the award is cancelled, and the capacity is reallocated through a fresh auction.

Recently, the government directed renewable energy implementing agencies to close all legacy bids and cancel the LoAs for all renewable energy projects for which PPAs and PSAs are not feasible by November 30, 2025.

Subscribe to Mercom’s real-time Regulatory Updates to ensure you don’t miss any critical updates from the renewable industry.