AFSIA Tracks 296 GW Solar Projects in Africa, with 23.4 GW Operational as of 2025

Report tracks 42,000 solar projects with 296 GW identified pipeline

January 21, 2026

Follow Mercom India on WhatsApp for exclusive updates on clean energy news and insights

Africa’s solar market has entered a new phase of scale and credibility, with the Africa Solar Industry Association (AFSIA) tracking more than 42,000 solar projects across the continent by the end of 2025, representing a total identified pipeline of 296 GW, of which 23.4 GW is already operational.

While only a fraction of this pipeline is currently operational, the scale signals long-term momentum.

For years, Africa was viewed as a marginal solar market accounting for less than 1% of global capacity, largely due to incomplete project tracking and weak official reporting. That perception has now been overturned. By incorporating new data sources, most notably Chinese photovoltaic module export data, the report sharply increases estimates of Africa’s installed solar capacity.

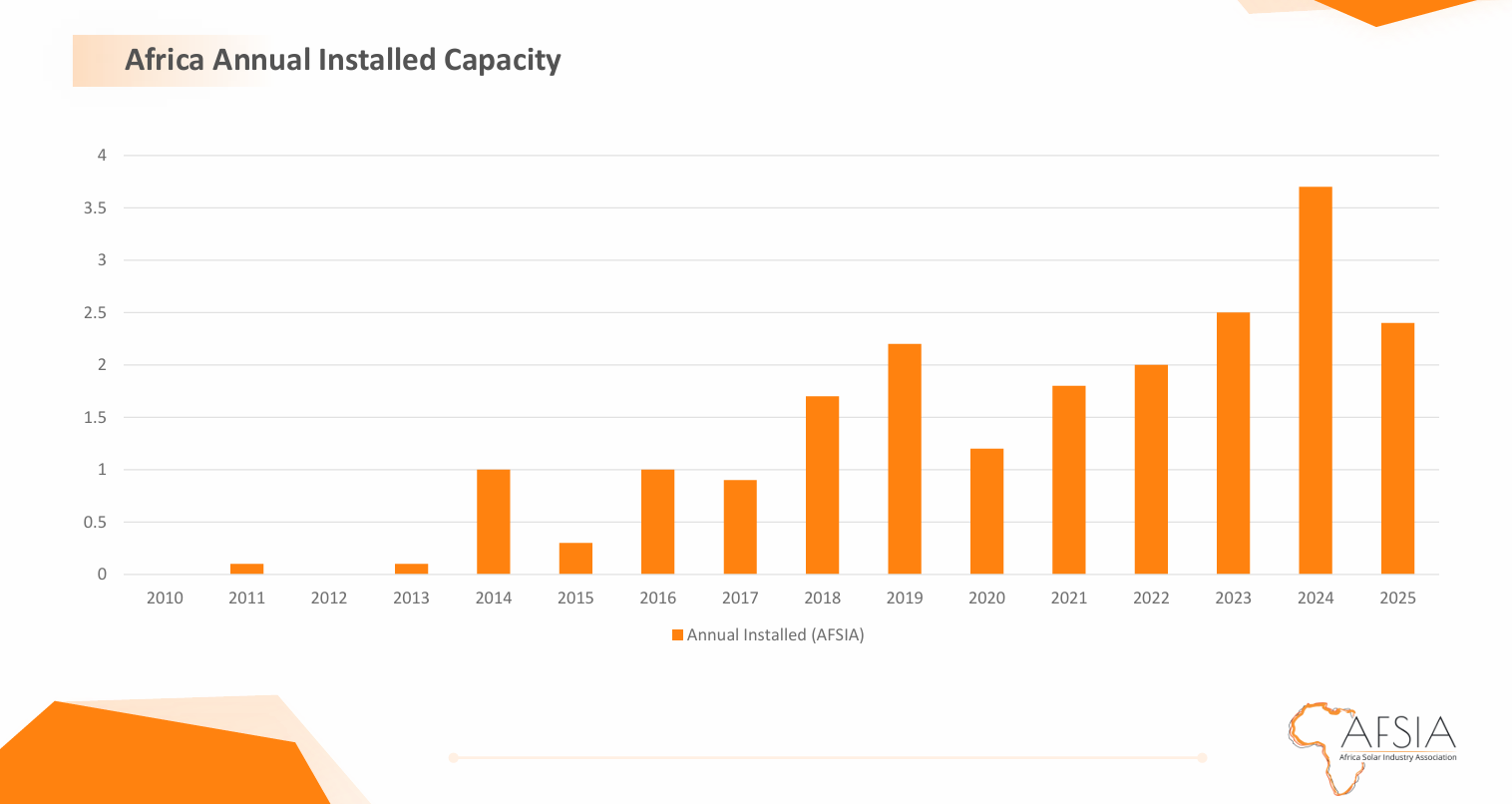

The data also highlights the pace of recent growth. Africa added around 14.8 GW of new solar capacity in 2025, compared to roughly 9.3 GW in 2023. Operational solar capacity reached 23.4 GW by the end of 2025, reflecting a 26% year-on-year increase.

Since 2021, Africa’s solar sector has grown at a compound annual growth rate of 49%, the highest of any global region. By comparison, global solar additions in 2025 were estimated at around 618 GW, within a range of 544 GW to 660 GW, underscoring Africa’s rapid expansion from a low base within a record-breaking global market.

Thirty-two African countries now generate more than 10% of their electricity from solar power, and 14 countries exceed 25% solar penetration in their electricity mix. Countries including Somalia, Chad, Tunisia, Tanzania, and the Democratic Republic of Congo recorded the fastest improvements in solar penetration rankings, reflecting both new capacity and structural reliance on solar generation.

Market Structure and Sectoral Shifts

The report segments Africa’s solar market into five core sectors: utility-scale solar, commercial and industrial (C&I) solar, residential solar, mini-grids, and solar home systems with productive-use applications.

Utility-scale solar remains the most visible and fully documented segment, driven by national independent power producer programs, competitive auctions replacing feed-in tariffs, and growing integration with battery storage in grid-constrained systems. However, the report makes clear that utility-scale solar is no longer the fastest-growing segment on the continent.

A significant share of imported solar modules had previously been classified as “unidentified” due to the absence of centralized reporting. Based on installer and developer feedback across African markets, AFSIA now attributes approximately 85% of this unidentified capacity to C&I systems and the remaining 15% to residential installations.

Growth in the C&I segment is driven by high grid tariffs, frequent outages, diesel displacement, and the need for reliable power, particularly in manufacturing, mining, and commercial real estate.

Increasingly, these systems are deployed with battery storage to enable load shifting, backup power, and partial energy independence.

Residential solar continues to grow but remains smaller in scale compared to C&I. Its expansion is closely linked to power reliability issues, the availability of net metering frameworks, declining system costs, and supportive import duty and value-added tax (VAT) regimes.

Mini-grids, largely government- or donor-led, remain well documented and play a strategic role in rural electrification, although their contribution in megawatt terms is limited.

Storage as a Structural Turning Point

Battery energy storage systems are identified as the defining technology trend for 2026. Utility-scale BESS costs declined to around $125/kWh by late 2025, while the levelized cost of storage fell to approximately $65/MWh.

These cost reductions have fundamentally changed project economics. Hybrid plus BESS projects in Africa are already delivering electricity at tariffs as low as $0.07/kWh, bringing dispatchable solar into direct competition with thermal generation.

Storage enables solar to provide grid services such as frequency regulation and reserve capacity, and allows near-baseload operation for mines, industrial facilities, island grids, and weak national systems.

As a result, standalone utility-scale solar without storage, while still expanding, faces rising curtailment risks and declining competitiveness in constrained grids.

Regional Patterns and Industrial Ambitions

North Africa, particularly Egypt, is positioning itself as a solar manufacturing and export hub, with integrated cell and module plants announced in 2025. East Africa leads in off-grid, C&I, and productive-use solar, with Kenya emerging as a center for local technology manufacturing, refurbishment, and early deployment of solar-backed e-mobility infrastructure.

The southern region of , led by South Africa, remains the continent’s largest solar market and is entering a new phase characterized by wholesale electricity market reforms and large-scale BESS deployment, with several projects scheduled for commercial operation by late 2026.

West Africa is expanding utility-scale solar through national programs, while increasing solar penetration in electricity mixes in countries such as Benin and Chad. Despite growing interest from global manufacturers, most local manufacturing remains focused on module assembly rather than full vertical integration.

Capital Constraints and Policy Risks

The report is explicit that Africa’s solar challenge is not a lack of demand but resistance to capital deployment. Equity investors typically seek double-digit returns, while competitive tariffs depend on debt priced at single-digit interest rates with leverage levels of around 70% or higher.

Currency mismatch remains a critical risk, as cheaper USD- or EUR-denominated debt exposes projects to foreign-exchange volatility when power purchase agreements are denominated in local currencies. Local-currency debt reduces foreign exchange risk but remains limited and more expensive.

Policy consistency is another decisive factor, with stable frameworks for net metering, wheeling, competitive procurement, and predictable import duty and VAT regimes directly influencing market growth.

Persistent data gaps, grid absorption limits, financing scalability, and permitting delays continue to pose challenges. The report also raises the question of whether recent acceleration is structural or partially crisis-driven, noting that power shortages in countries such as South Africa have amplified demand.

Nevertheless, Africa Solar Outlook 2026 concludes that the continent’s solar sector has moved from the margins to a central role in the power sector, with future outcomes determined less by technology availability and more by financing speed, grid readiness, and policy stability.

In 2023, the Africa Solar Industry Association (AFSIA) reported that Africa added 989 MW of solar capacity, a 14% year-over-year increase.