Q4 & ANNUAL 2025 INDIA SOLAR OPEN ACCESS MARKET REPORT – 7.8 GW INSTALLED IN 2025

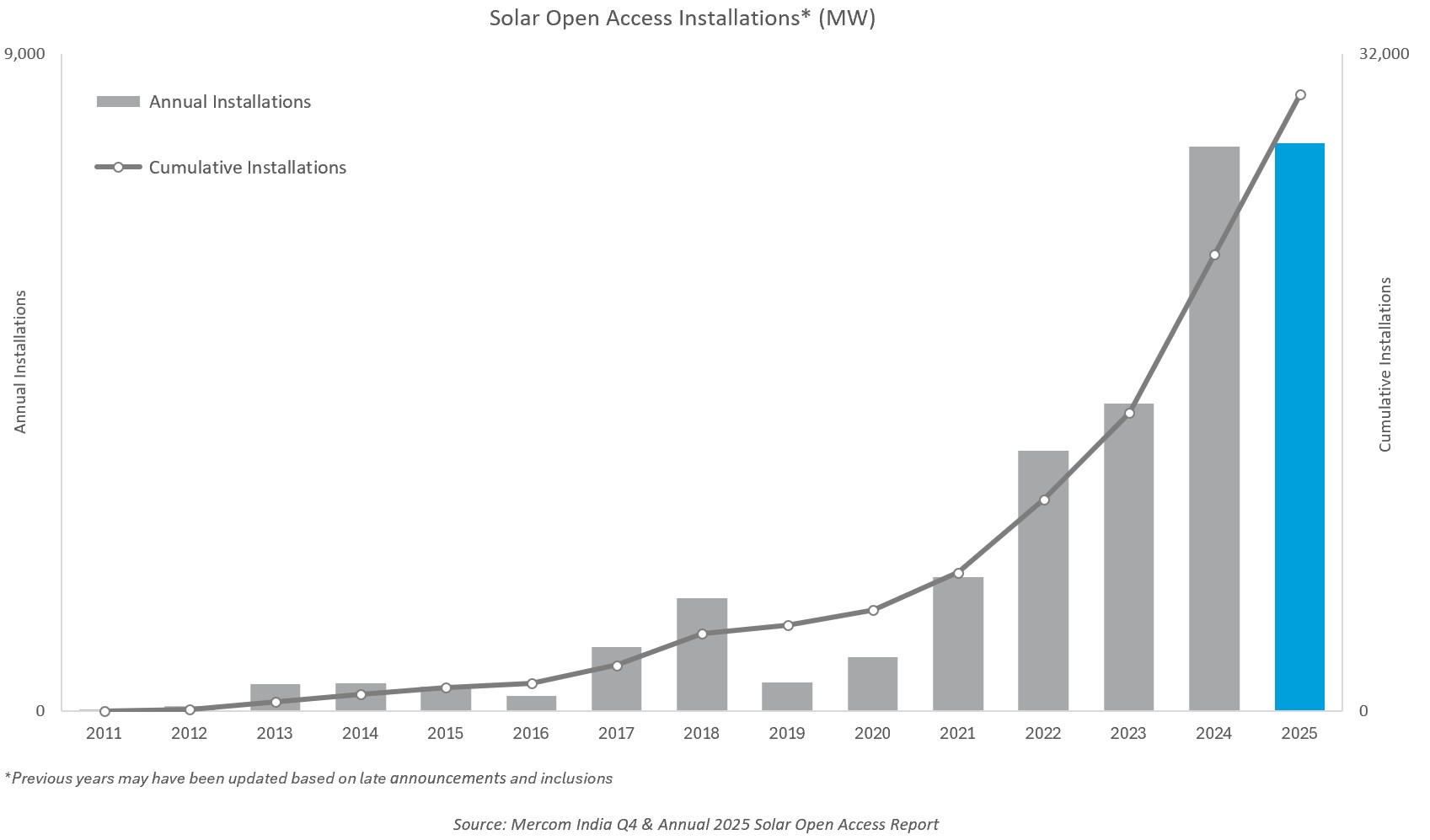

In calendar year (CY) 2025, India added 7.8 gigawatts (GW) of solar open access capacity, a marginal increase of 0.5% compared to the 7.7 GW installed in 2024, marking the highest annual capacity additions, according to the newly released report by Mercom India, Q4 & Annual 2025 India Solar Open Access Market Report.

The front-loaded installation pattern in the first half of 2025 strongly influenced annual deployments, helping reach a new high in total additions despite relatively flat year-over-year growth.

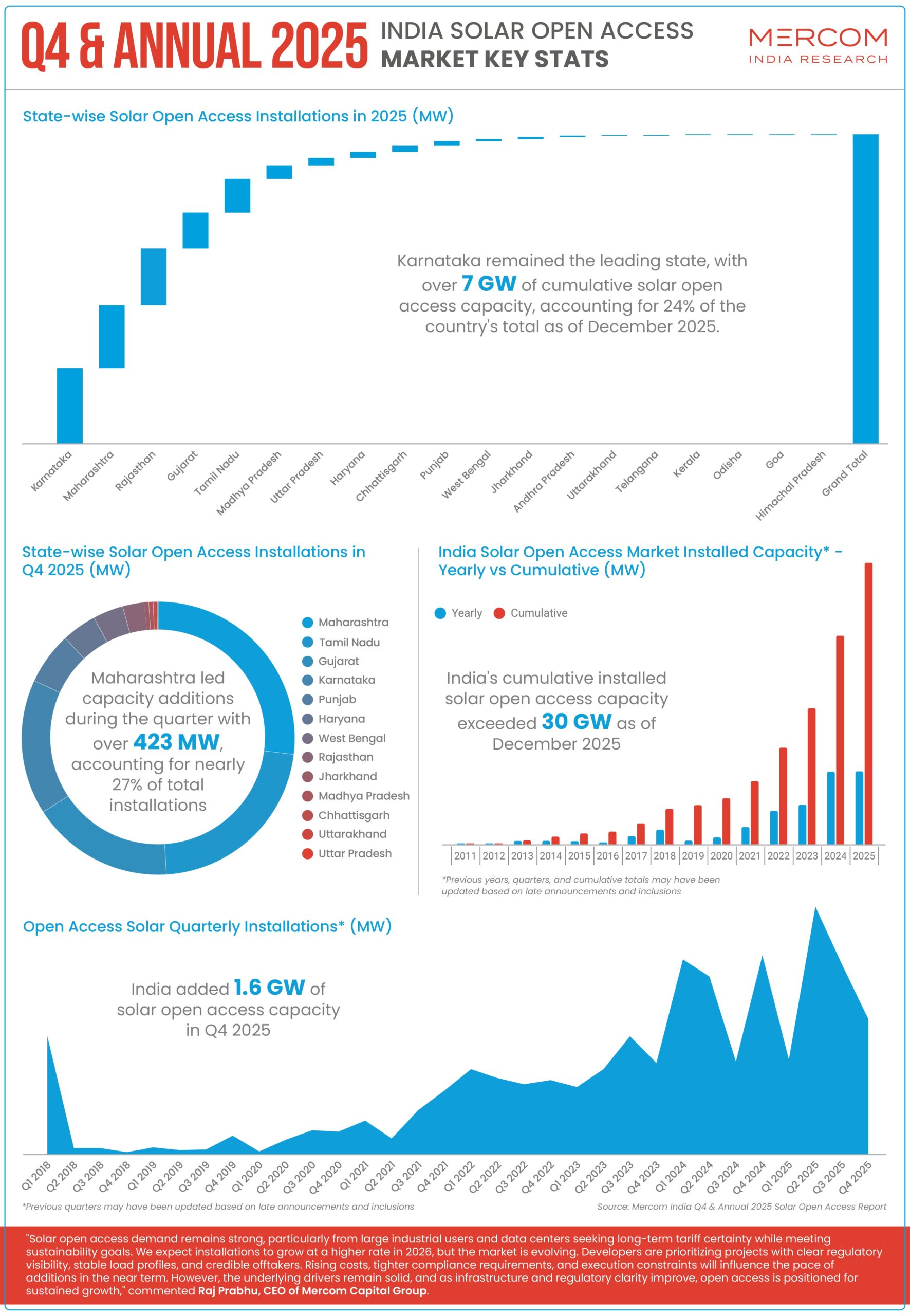

In 2025, Karnataka led Indian states, accounting for over 24% of new solar installations. Maharashtra and Rajasthan followed, contributing over 20% and 18%, respectively, to the annual capacity additions.

In Q4, India added solar open access capacity of 1.6 GW, a decrease of about 29% compared to 2.2 GW in Q3 2025 and over 32% decrease compared to 2.3 GW in Q4 2024.

Installations in the fourth quarter (Q4), however, declined because many projects originally scheduled for the second half of 2025 were completed earlier and commissioned before the ISTS charge waiver expired in June. This early execution reduced the number of projects available for commissioning later in the year.

Maharashtra, Tamil Nadu, and Gujarat led Q4 2025 installations, contributing 27%, 22%, and 17% to capacity additions, respectively.

Cumulative installed solar capacity in the open access segment surpassed 30 GW as of December 2025, reflecting steady growth in the segment over the past few years.

India had more than 45 GW of solar open access projects under development and in the pre-construction phase at the end of Q4 2025.

There was an 18% increase QoQ in the Green Day-Ahead Market (G-DAM). Adani Green Energy led energy sales in the Green Day-Ahead Market (G-DAM), accounting for 38% of electricity traded.

Odisha procured the highest volume of electricity at G-DAM, accounting for 23% of the electricity traded.

The cleared volume of Renewable Energy Certificates traded on the Indian Energy Exchange (IEX) fell almost 58% quarter-over-quarter (QoQ).

According to the report, the volume traded in the Green Term Ahead Market (G-TAM) on IEX decreased by 32% QoQ.

The report covers a detailed analysis of the solar open access market, retail electricity tariffs, and open access charges and costs for fifteen states.

Key Highlights from Mercom India Research’s Q4 & Annual 2025 India Solar Open Access Market Report

- India added over 7.8 GW open access solar in CY 2025, a 0.5% increase from the 7.7 GW installed in 2024

- Karnataka, Maharashtra, and Rajasthan added the highest solar open access capacity in 2025

- India added 1.6 GW of open access solar in Q4 2025, a decrease of 29% QoQ and 32% YoY

- India’s cumulative installed solar open access capacity crossed 30 GW as of December 2025

- The country had more than 45 GW of solar open access projects in various stages of development at the end of 2025

Contact Mercom for pricing: reports@mercomindia.com or call us at +91-80-41211148.

MERCOM INDIA RESEARCH

Mercom India Research is a leading research and consulting firm at the forefront of India’s clean energy transformation delivering timely, relevant market intelligence and advisory for India’s energy markets.

RELATED NEWS

CUSTOM RESEARCH & CONSULTING

Do you need more tailored research that cannot be answered by any of Mercom’s popular reports?

Our custom research services may be the answer.

We provide data and analysis to help companies understand information specific to their particular segment so they can make sound strategic decisions relating to new market entry, product introductions, or to simply help them understand how they or their customers are positioned within the market.

Mercom’s custom research and advisory services provide clients data and analysis tailored to meet their unique needs. Call us today to learn more: research@mercomindia.com